Futures Trading Essentials: Your Complete Guide to Mastering the Market

Futures trading presents a world of opportunity for savvy investors, but it also comes with its unique set of challenges. If you’re looking to navigate this dynamic market, understanding the core concepts is paramount. This guide will equip you with the essential concepts for getting started in futures trading, breaking down everything from the basics of futures contracts to effective risk management futures trading and proven futures trading strategies. Let’s dive into the essentials of Futures Trading.

What are Futures Contracts? Understanding the Basics

At the heart of futures trading lies the futures contract. Grasping what these instruments are and how they function is the first step towards successful trading.

Defining Futures Contracts

A futures contract is a legally binding, standardized agreement to buy or sell a specific underlying asset at a predetermined price on a specified future date. Think of it as a contract to make a transaction later, but with the terms locked in today.

Obligation vs. Right

It’s crucial to understand that futures contracts entail an obligation for both the buyer (long position) and the seller (short position). The buyer is obligated to purchase the underlying asset, and the seller is obligated to sell it at the agreed-upon terms if the contract is held until expiry. This differs significantly from options contracts, where the buyer has the right but not the obligation to buy or sell.

Underlying Assets in Futures Trading

Futures contracts can be based on a wide array of underlying assets. Common categories include:

- Commodities:

- Agricultural products (e.g., corn, wheat, soybeans, live cattle)

- Energy products (e.g., crude oil, natural gas, gasoline)

- Metals (e.g., gold, silver, copper)

- Financial Instruments:

- Currencies (e.g., Euro, Japanese Yen, British Pound)

- Stock Market Indexes (e.g., S&P 500, Nasdaq 100, Dow Jones Industrial Average)

- Interest Rates (e.g., Treasury Bonds, Eurodollar)

Futures vs. Stocks

While both involve speculating on price movements, futures trading differs from stock trading in several key ways:

- Ownership: When you buy a stock, you gain ownership in a company. With futures, you don’t own the underlying asset itself (unless the contract is held to delivery); you own a contract to buy or sell it.

- Leverage: Futures trading typically involves higher leverage, meaning a smaller amount of capital can control a larger contract value. This amplifies both potential profits and potential losses.

- Expiration: Stock positions can theoretically be held indefinitely. Futures contracts have specific expiration dates.

- Profit/Loss Realization: Profits and losses in futures are often marked-to-market daily, meaning changes in contract value are credited or debited to your account each trading day.

Futures vs. Forward Contracts

Both futures and forward contracts are agreements to transact an asset at a future date and price. However, key differences include:

- Standardization: Futures contracts are highly standardized in terms of quantity, quality, and delivery terms, making them easily tradable on exchanges. Forward contracts are customized agreements between two parties and are typically traded over-the-counter (OTC).

- Trading Venue: Futures contracts trade on centralized, regulated exchanges. Forward contracts are private agreements.

- Counterparty Risk: Futures exchanges have clearing houses that act as the counterparty to every trade, significantly reducing counterparty risk. Forward contracts carry direct counterparty risk.

How Futures Trading Works: Mechanics and Participants

Understanding the operational side of futures trading is essential for anyone looking to participate in these markets.

The Role of Futures Exchanges

Futures contracts are traded on organized and regulated exchanges. Prominent examples include the CME Group (Chicago Mercantile Exchange), Intercontinental Exchange (ICE), and Cboe Global Markets. These exchanges provide a centralized marketplace, ensure transparency, and establish rules for trading.

Standardization of Futures Contracts

Standardization is a cornerstone of futures trading. Each contract specifies:

- The exact quantity of the underlying asset (e.g., 5,000 bushels of corn, 1,000 barrels of oil).

- The quality or grade of the asset.

- The delivery location and procedures (if physically settled).

- The contract months available for trading.

This standardization allows for liquidity and efficient price discovery, as all participants are trading the same instrument.

Key Market Participants

Two primary types of participants drive activity in the futures markets:

- Hedgers: These are typically businesses or individuals who use futures contracts to manage or mitigate price risk associated with their underlying business operations. For example, a farmer might sell corn futures to lock in a price for their upcoming harvest, protecting against a potential price decline. An airline might buy oil futures to hedge against rising fuel costs.

- Speculators: These traders aim to profit from anticipated price movements in the underlying asset. They do not typically intend to make or take delivery of the asset but rather to close out their positions before expiration for a profit. Speculators provide essential liquidity to the market.

Price Discovery in Futures Markets

Futures markets play a vital role in price discovery. The continuous buying and selling of futures contracts by hedgers and speculators reflects the collective market sentiment and expectations about future supply, demand, and other economic factors. This process helps establish a fair market price for the underlying asset.

Essential Concepts and Mechanics in Futures Trading

Beyond the basics, several key concepts and mechanics are fundamental to futures trading.

Understanding Margin in Futures

Margin in futures trading is often misunderstood. It’s not a down payment on the underlying asset, as it is in stock trading. Instead, it’s a good-faith deposit, or performance bond, required by the exchange to ensure that traders can meet their obligations.

- Initial Margin: The amount of money you must deposit when you first open a futures position.

- Maintenance Margin: The minimum amount of equity that must be maintained in your account once a position is open. If your account balance falls below the maintenance margin due to adverse price movements, you’ll receive a margin call, requiring you to deposit additional funds to bring the account back up to the initial margin level.

- Margin requirements are set by the exchanges and can change based on market volatility. Leverage means that a small price movement can have a significant impact on your margin account.

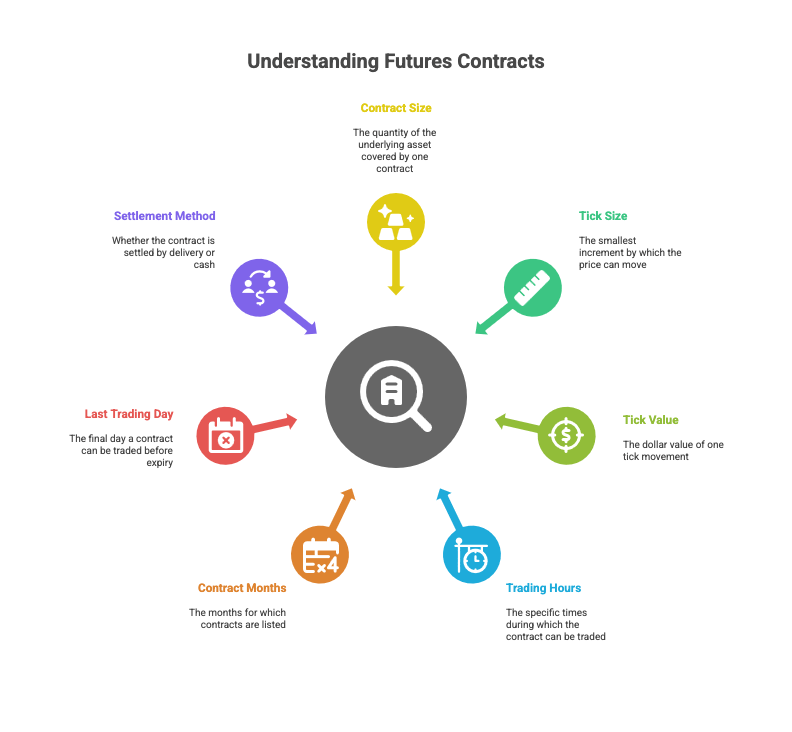

Decoding Contract Specifications

Each futures contract has unique specifications that traders must understand before trading. These include:

- Contract Size: The quantity of the underlying asset covered by one contract (e.g., 100 troy ounces for a gold contract).

- Tick Size (Minimum Price Fluctuation): The smallest increment by which the price of a contract can move (e.g., $0.0025 per bushel for corn).

- Tick Value: The dollar value of one tick movement (e.g., if corn’s tick size is $0.0025 and contract size is 5,000 bushels, the tick value is $12.50).

- Trading Hours: The specific times during which the contract can be traded.

- Contract Months: The months for which contracts are listed and can be traded.

- Last Trading Day: The final day a particular contract month can be traded before expiry.

- Settlement Method: Whether the contract is settled by physical delivery of the underlying asset or by a cash settlement.

Example: E-mini S&P 500 Index Futures Contract Specifications

- Underlying Asset: S&P 500 Index

- Exchange: CME Group

- Contract Size: $50 x S&P 500 Index value

- Tick Size: 0.25 index points

- Tick Value: $12.50 (0.25 points x $50)

- Settlement: Cash Settled

Understanding these details is crucial for calculating potential profits and losses and for effective risk management futures trading.

Pricing of Futures Contracts

The price of a futures contract is influenced by several factors:

- Spot Price: The current market price of the underlying asset.

- Cost of Carry: This includes storage costs (for physical commodities), financing costs (interest rates), and insurance.

- Time to Expiration: Generally, the further out the expiration date, the greater the potential for price divergence from the spot price due to increased uncertainty and carrying costs.

- Market Expectations: Anticipated changes in supply, demand, economic conditions, and geopolitical events all play a role.

- Convenience Yield: For commodities, this refers to the benefit of holding the physical asset, which can influence futures prices, especially in times of scarcity.

Expiry and Final Settlement

All futures contracts have a defined expiration date. What happens at expiration depends on the type of contract:

- Physical Delivery: For many commodity futures (e.g., oil, grains), contracts held to expiration result in the physical delivery of the underlying asset. Sellers must deliver the asset, and buyers must take delivery. Most speculators close their positions before expiration to avoid this.

- Cash Settlement: Many financial futures (e.g., stock index futures, interest rate futures) are cash-settled. At expiration, the difference between the contract price and the final settlement price of the underlying asset is paid or received in cash.

Navigating Trading Orders

Placing orders correctly is vital for executing your futures trading strategies effectively and managing risk. Common order types include:

- Market Order: An order to buy or sell at the best available current price. It guarantees execution but not the price.

- Limit Order: An order to buy or sell at a specific price or better. A buy limit order is placed below the current market price, and a sell limit order is placed above. Execution is not guaranteed if the market doesn’t reach your limit price.

- Stop Order (Stop-Loss Order): An order to buy or sell a contract once its price reaches a specified level (the stop price). Once the stop price is hit, the order becomes a market order. Used to limit losses or protect profits.

- Stop-Limit Order: Combines features of a stop order and a limit order. Once the stop price is reached, the order becomes a limit order to buy or sell at the limit price or better. This offers more price control than a regular stop order but risks non-execution if the market moves rapidly past the limit price.

- Market-if-Touched (MIT) Order: An order to buy or sell if the market reaches a specified price. Similar to a stop order, but an MIT buy order is placed below the current market price, and an MIT sell order is placed above.

Understanding the nuances of each order type is crucial for effective trade execution and risk management futures trading.

Key Futures Trading Strategies Explored

Successful futures trading often involves applying well-defined strategies. While no strategy guarantees profits, understanding different approaches can help you make more informed decisions.

Technical Analysis in Futures Trading

Technical analysis involves studying historical price charts and trading volumes to identify patterns and trends that might predict future price movements. Common tools include:

- Candlestick Charts: Provide visual information about price movements (open, high, low, close) over specific periods.

- Support and Resistance Levels: Price levels where the market has historically had difficulty breaking through. Support is a level where buying pressure tends to overcome selling pressure, and resistance is where selling pressure tends to overcome buying pressure.

- Trendlines: Lines drawn on a chart to indicate the prevailing direction of price movement.

- Moving Averages: Smooth out price data to identify trends by calculating the average price over a specific period.

- Technical Indicators: Mathematical calculations based on price and/or volume, such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands, used to generate trading signals or confirm trends.

Fundamental Analysis for Futures

Fundamental analysis focuses on the underlying factors that influence the supply and demand of an asset, and therefore its price. This can include:

- Economic Reports: Data on inflation, employment, GDP growth, and interest rate decisions by central banks.

- Supply and Demand Dynamics: For commodities, this includes weather patterns, crop reports, inventory levels, and geopolitical events affecting production (e.g., OPEC decisions for oil).

- Company or Sector News: For single-stock futures or sector-based index futures.

- Global Events: Political instability, trade wars, or natural disasters can significantly impact various futures markets.

Many traders use a combination of technical and fundamental analysis to inform their futures trading strategies.

Popular Futures Trading Strategies

Several strategic approaches are common in futures trading:

- Trend Trading: Identifying the prevailing market trend (up, down, or sideways) and trading in the direction of that trend.

- Breakout Trading: Entering a trade when the price breaks above a resistance level or below a support level, anticipating a continuation of the move.

- Range Trading (Channel Trading): Identifying a price range or channel where an asset has been trading and buying near the bottom of the range (support) and selling near the top (resistance).

- Pullback Trading: Waiting for a temporary price dip (pullback) within an established uptrend to enter a long position, or a temporary rally within a downtrend to enter a short position.

- News Trading: Making trading decisions based on the anticipated or actual impact of economic news releases or other significant events. This can be very volatile and requires quick decision-making.

- Price Action Trading: Making trading decisions based purely on the movement of price itself, often using candlestick patterns and support/resistance levels without relying heavily on indicators.

Time Horizons: Scalping, Day Trading, and Swing Trading

Futures trading strategies can also be categorized by their holding periods:

- Scalping: A very short-term strategy where traders aim to make small profits on numerous trades throughout the day, often holding positions for only seconds or minutes. Scalpers focus on small price movements (ticks).

- Day Trading: Traders open and close all their positions within the same trading day, avoiding overnight risk. They might hold trades for minutes to hours.

- Swing Trading: Positions are held for more than a day but typically for a few days to a few weeks or months. Swing traders aim to capture larger price swings or “swings” in the market.

Futures Spread Trading

Spread trading involves simultaneously buying one futures contract and selling another related futures contract. The goal is to profit from the change in the price difference (the “spread”) between the two contracts, rather than from the outright direction of the market. Types of spreads include:

- Intra-market Spreads (Calendar Spreads): Buying and selling the same futures contract but with different expiration months (e.g., buying May Corn and selling December Corn).

- Inter-market Spreads: Buying and selling futures contracts on different but related underlying assets (e.g., buying Crude Oil and selling Heating Oil).

- Spread trading can sometimes offer lower risk and lower margin requirements compared to outright futures positions.

Managing Risk Effectively in Futures Trading

Futures trading involves substantial risk, primarily due to the leverage involved. A small adverse price movement can lead to significant losses. Therefore, effective risk management futures trading is not just important; it’s crucial for survival and long-term success.

Why Risk Management is Crucial

Leverage amplifies both gains and losses. Without a disciplined approach to risk, traders can quickly deplete their capital. Market volatility can lead to rapid price changes, making it essential to have a plan to protect your investment.

Developing a Solid Trading Plan

A well-defined trading plan is your roadmap. It should outline:

- Trading Goals: What you aim to achieve.

- Risk Tolerance: How much you are willing to risk per trade, per day, and overall.

- Markets to Trade: Which futures contracts you will focus on.

- Strategies to Employ: Your chosen futures trading strategies.

- Entry and Exit Criteria: Specific rules for when to enter and exit trades (both for profits and losses).

- Money Management Rules: How you will manage your capital and position sizing.

- A trading plan helps maintain discipline, especially during periods of market stress or emotional decision-making.

Conservative Position Sizing

One of the most critical aspects of risk management futures trading is position sizing. This refers to determining how many contracts to trade based on your account size and risk tolerance.

- The 1% Rule (or similar): A common guideline is to risk no more than 1% (or perhaps 2%) of your trading capital on any single trade. This means if you have a $10,000 account, you wouldn’t risk more than $100-$200 on one trade.

- Avoid Over-Leveraging: While leverage can magnify profits, using too much leverage is a common mistake that can lead to rapid and substantial losses.

- Proper position sizing helps you withstand a series of losing trades without blowing up your account.

Implementing Stop-Loss Orders

A stop-loss order is an essential risk management tool. It’s an order placed with your broker to automatically close out your position if the price reaches a predetermined level, thereby limiting your potential loss on that trade.

- “Know where you’re going to get out before you get in.” This means deciding your stop-loss point before you enter a trade.

- Place stop-loss orders based on your technical analysis (e.g., below a support level for a long trade) or a fixed percentage/dollar amount you’re willing to risk.

- Be aware that in fast-moving markets, stop-loss orders can experience slippage (executed at a worse price than the stop price).

The Role of Psychological Discipline

The psychological aspect of trading is often underestimated. Fear and greed are powerful emotions that can lead to impulsive and irrational decisions.

- Stick to Your Plan: Discipline means adhering to your trading plan, even when it’s difficult.

- Accept Losses: Losses are an inevitable part of trading. Don’t let a losing trade turn into a catastrophic one by refusing to cut it.

- Avoid Revenge Trading: Trying to make back losses quickly by taking on excessive risk.

- Patience: Wait for high-probability setups according to your strategy, rather than trading out of boredom or impatience.

Avoiding Common Mistakes in Futures Trading

Many beginners (and even some experienced traders) fall prey to common pitfalls:

- Lack of a Trading Plan: Trading without a plan is like navigating without a map.

- Using Too Much Leverage: Leading to amplified losses.

- Failing to Control Risk: Not using stop-loss orders or risking too much per trade.

- Overtrading: Trading too frequently, often without a clear edge.

- Emotional Trading: Letting fear, greed, or hope dictate decisions.

- Lack of Education: Not fully understanding the markets or the instruments being traded.

- Chasing Past Performance: Assuming a strategy that worked in the past will always work in the future.

Tools and Resources for Futures Traders

The right tools and resources can significantly enhance your futures trading experience and decision-making process.

Choosing a Futures Trading Platform

Selecting a suitable futures trading platform is a critical first step. Consider these factors:

- Commissions and Fees: Compare brokerage costs, as they can impact profitability, especially for active traders.

- Trading Tools and Features: Look for platforms with advanced charting capabilities, a wide range of order types, technical indicators, and market analysis tools.

- Asset Availability: Ensure the platform offers the futures contracts you intend to trade.

- Educational Resources: Many brokers provide extensive educational materials, webinars, and tutorials.

- Customer Support: Reliable and accessible customer service is important.

- Platform Stability and Speed: Crucial for timely order execution.

- Ease of Use: The platform should be intuitive and user-friendly, especially for beginners.

- Popular futures trading platforms include E*TRADE, Interactive Brokers, NinjaTrader, TD Ameritrade (now part of Charles Schwab), and TradeStation.

Utilizing Paper Trading

Paper trading (also known as simulated trading or demo accounts) allows you to practice your futures trading strategies in a real-market environment but with virtual money.

- Benefits:

- Learn the mechanics of the trading platform.

- Test strategies without risking real capital.

- Build confidence and discipline.

- Limitations:

- Does not replicate the emotional pressures of trading with real money.

- Order fills might be more idealized than in live trading.

- Fees and commissions are often not factored in.

- Despite limitations, paper trading is an invaluable tool, especially for those getting started in futures trading.

Educational Resources for Futures Trading

Continuous learning is key in the ever-evolving world of futures markets.

- Brokerage Firms: Most futures trading platforms and brokers offer a wealth of educational content, including articles, videos, webinars, and courses.

- Exchange Websites: Exchanges like CME Group provide extensive information on their contracts, market data, and educational resources.

- Financial News Websites: Reputable sites like Investopedia, Bloomberg, Reuters, and The Wall Street Journal offer market news, analysis, and educational articles.

- Books on Trading: Many classic and contemporary books cover futures trading strategies, technical analysis, and trading psychology.

- Online Courses and Communities: Various platforms offer specialized courses and forums where traders can learn and share insights.

Market Analysis Tools

Staying informed and analyzing market conditions is crucial:

- Economic Calendar: Tracks upcoming economic data releases (e.g., inflation reports, employment numbers, central bank announcements) that can impact markets.

- News Feeds: Real-time news services to stay updated on events affecting your traded markets.

- Charting Software: Advanced charting packages for technical analysis.

- Market Scanners: Tools to identify trading opportunities based on predefined criteria.

Frequently Asked Questions About Futures Trading (FAQs)

Here are answers to some common questions about futures trading:

How do I get started in futures trading?

- Educate Yourself: Thoroughly understand what futures contracts are, how they work, the risks involved, and basic futures trading strategies.

- Develop a Trading Plan: Outline your goals, risk tolerance, and strategies.

- Choose a Reputable Broker and Platform: Select one that suits your needs and offers futures trading.

- Start with Paper Trading: Practice on a demo account to get familiar with the platform and test your strategies without risking real money.

- Fund Your Account: Start with an amount you can afford to lose.

- Start Small: Begin with smaller position sizes as you gain experience.

What are the main risks of trading futures?

- Leverage Risk: Leverage magnifies both potential profits and potential losses. You can lose more than your initial margin.

- Market Volatility: Futures prices can be highly volatile and change rapidly.

- Liquidity Risk: Some contracts may have low trading volume, making it difficult to enter or exit positions at desired prices.

- Gap Risk: Prices can “gap” up or down significantly between trading sessions or after major news events, potentially bypassing stop-loss orders.

- Counterparty Risk (minimized by exchanges): While exchanges act as clearinghouses, there’s always a theoretical, albeit small, risk associated with the clearinghouse itself.

Can you lose more than your initial investment in futures?

Yes, it is possible to lose more than your initial margin deposit in futures trading. Because futures are traded on margin, adverse price movements can lead to losses exceeding the funds in your account, resulting in a debit balance that you would be obligated to cover. This is a key reason why risk management futures trading is so critical.

What is futures margin, and how does it work?

Futures margin is a good-faith deposit required to open and maintain a futures position. It’s not a down payment but rather a performance bond to ensure traders can cover potential losses. There’s an initial margin to open a trade and a maintenance margin that must be kept in the account. If the account drops below the maintenance level, a margin call is issued.

Is futures trading suitable for beginners?

Futures trading can be complex and carries significant risk, making it potentially challenging for absolute beginners with no prior trading or investment experience. However, with proper education, a disciplined approach, diligent risk management futures trading, starting with paper trading, and beginning with a small amount of risk capital, beginners can learn to navigate these markets. It requires a serious commitment to learning and a realistic understanding of the risks involved.

Where can I find educational resources for futures trading?

- Your chosen futures trading platform or broker.

- Websites of major futures exchanges (e.g., CME Group).

- Reputable financial education websites (e.g., Investopedia).

- Books on trading and technical analysis.

- Online courses and trading communities.

Navigating Your Futures Trading Journey

Embarking on your futures trading journey can be both exciting and challenging. Success hinges on a thorough understanding of futures contracts, market mechanics, effective futures trading strategies, and, most importantly, disciplined risk management futures trading.

Remember that a solid trading plan, a commitment to continuous learning, and emotional discipline are your best allies. Don’t be afraid to start small, practice extensively (paper trading is your friend!), and never risk more capital than you can afford to lose. While the allure of quick profits can be strong, a patient, educated, and risk-aware approach is far more likely to lead to sustainable success in the dynamic world of futures trading.

Ready to explore the world of futures trading further?

- Open a demo account today with a reputable futures trading platform and start practicing your strategies risk-free!

- Dive deeper into futures contracts and advanced futures trading strategies by exploring our comprehensive educational resources.

- Compare and find the best futures trading platform that aligns with your trading goals and needs.

Take the next step in your trading education and empower yourself with the knowledge to navigate the futures markets.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial advice. Futures trading involves significant risk, losses can exceed deposits, and is not suitable for all investors. Consult with a qualified financial advisor before making any investment decisions.

This website may utilize artificial intelligence to assist in the creation of content. This may include generating ideas, drafting sections, and aiding in the editing process. All content is reviewed and edited by us to ensure accuracy and quality.