Mastering Options Trading Strategies: A Comprehensive Guide

Are you looking to diversify your portfolio or potentially generate income beyond traditional stock investing? Options trading strategies offer a powerful set of tools for navigating various market conditions. While often perceived as complex or highly speculative, options, when used correctly and with a clear plan, can provide unique advantages not found in simply buying and selling stocks.

This comprehensive guide, drawing on insights from experienced traders and educational resources, will walk you through the fundamentals, pricing dynamics, and diverse options trading strategies available. We’ll explore how to approach options trading with a strategic mindset, manage risk effectively, and utilize modern online tools to build a solid foundation for potential success.

Whether you’re a beginner seeking to understand the basics or an investor looking to enhance your existing approach, mastering options trading strategies is a necessary investment.

Understanding the Fundamentals of Options Trading

Before diving into specific strategies, it’s crucial to grasp the core concepts of options trading. This foundational knowledge will empower you to make informed decisions.

What are Options? Basic Concepts Explained

At its heart, an option is a contract that gives the buyer the right, but not the obligation, to either buy or sell an underlying asset at a predetermined price on or before a specific date.

- Options as Contracts: Rights, Not Obligations. This is a key distinction. Unlike futures contracts, where the holder is obligated to buy or sell, an options holder can choose not to exercise their right if it’s not financially advantageous.

- Underlying Assets: Stocks, ETFs, Indexes, and Commodities. Options can be based on a wide variety of assets. The most common are individual stocks, but you can also trade options on Exchange Traded Funds (ETFs), market indexes (like the S&P 500), and commodities (like gold or oil).

Call Options vs. Put Options: The Two Core Types

There are two fundamental types of options contracts:

- Call Options: The Right to Buy. A call option gives the holder the right to buy the underlying asset at the strike price on or before the expiration date. Investors typically buy calls when they are bullish on the underlying asset, expecting its price to rise.

- Put Options: The Right to Sell. A put option gives the holder the right to sell the underlying asset at the strike price on or before the expiration date. Investors typically buy puts when they are bearish on the underlying asset, expecting its price to fall, or to hedge existing long positions.

Essential Options Terminology for New Traders

Familiarizing yourself with these terms is essential for understanding options trading strategies:

- Strike Price (Exercise Price): The Predetermined Price. This is the price at which the underlying asset can be bought (for calls) or sold (for puts) if the option is exercised.

- Expiration Date: When the Contract Expires. This is the last day the option contract is valid. For US-listed stock options, this is typically the third Friday of the expiration month.

- Option Premium: The Price of the Contract. This is the cost of buying the option contract. It’s quoted on a per-share basis, and since most option contracts represent 100 shares of the underlying asset, you multiply the premium by 100 to get the total cost (excluding commissions).

- In the Money (ITM), At the Money (ATM), and Out of the Money (OTM) Explained.

- ITM: A call option is ITM if the underlying asset’s price is above the strike price. A put option is ITM if the underlying asset’s price is below the strike price.

- ATM: An option is ATM if the underlying asset’s price is equal to (or very close to) the strike price.

- OTM: A call option is OTM if the underlying asset’s price is below the strike price. A put option is OTM if the underlying asset’s price is above the strike price.

Why Trade Options? Exploring the Key Advantages

Options trading offers several compelling advantages for investors:

- Leverage Potential: Options allow traders to control a large amount of underlying stock with a relatively small capital outlay (the premium paid). This can amplify potential profits (and losses).

- Flexibility in Different Market Conditions: Options trading strategies can be tailored for bullish, bearish, neutral, or volatile market outlooks.

- Potential for Income Generation: Certain strategies, like covered calls or selling cash-secured puts, can generate regular income.

- Risk Management Capabilities (Hedging): Options can be used to protect existing stock positions against adverse price movements. For example, buying a put option on a stock you own can limit your downside risk.

Understanding the Risks Involved in Options Trading

While options offer significant opportunities, they also come with inherent risks:

- Options Trading Is Not Suitable for All Investors. Due to the potential for significant losses, options trading requires a good understanding of the risks and is not appropriate for everyone.

- Risk of Losing the Entire Premium Paid. When you buy an option, the maximum you can lose is the premium you paid for the contract if the option expires worthless (OTM).

- Unlimited Risk Potential in Certain Strategies. Some advanced options trading strategies, like writing (selling) naked calls, carry the risk of theoretically unlimited losses. It’s crucial to understand these risks before employing such strategies.

How Options are Priced: Key Factors and Models

Understanding what drives option prices is fundamental to developing effective options trading strategies. Several factors interact to determine the premium of an option.

The Components of Option Price: Intrinsic Value and Time Value

An option’s premium is composed of two main parts:

- Intrinsic Value: The “In-the-Money” Portion. This is the amount by which an option is ITM.

- For a call option: Intrinsic Value = Underlying Stock Price – Strike Price (if positive, otherwise zero).

- For a put option: Intrinsic Value = Strike Price – Underlying Stock Price (if positive, otherwise zero).

- OTM options have zero intrinsic value.

- Time Value (Extrinsic Value): The Value Beyond Intrinsic Value. This represents the amount an investor is willing to pay for the possibility that the option will become more profitable before expiration. Time value is influenced by factors like time until expiration and implied volatility.

The Critical Role of Volatility: Historical vs. Implied Volatility

Volatility is a measure of the expected magnitude of price fluctuations in the underlying asset. It’s a crucial determinant of option prices.

- What is Volatility? Measuring Price Swings. Higher volatility means a greater chance of large price moves (up or down), which increases the likelihood that an option will finish ITM.

- Historical Volatility: Looking at Past Price Movements. This is calculated based on the actual price changes of the underlying asset over a specific past period.

- Implied Volatility (IV): Market Expectation of Future Volatility. This is a forward-looking measure derived from the current market prices of options themselves. It reflects the market’s consensus on how volatile the underlying asset is expected to be in the future.

- How Implied Volatility Impacts Option Prices. Higher implied volatility generally leads to higher option premiums (for both calls and puts) because there’s a greater perceived chance of a significant price move. Conversely, lower IV leads to lower premiums. Many options trading strategies are designed to profit from changes in implied volatility.

Time Decay Explained: Theta’s Impact on Option Value

- Options Lose Value as Expiration Approaches. All else being equal, an option’s time value erodes as it gets closer to its expiration date. This phenomenon is known as time decay.

- Impact on Buyers vs. Writers (Sellers). Time decay works against option buyers (as their purchased asset is losing value over time) and benefits option sellers (as the options they sold become less valuable, potentially expiring worthless).

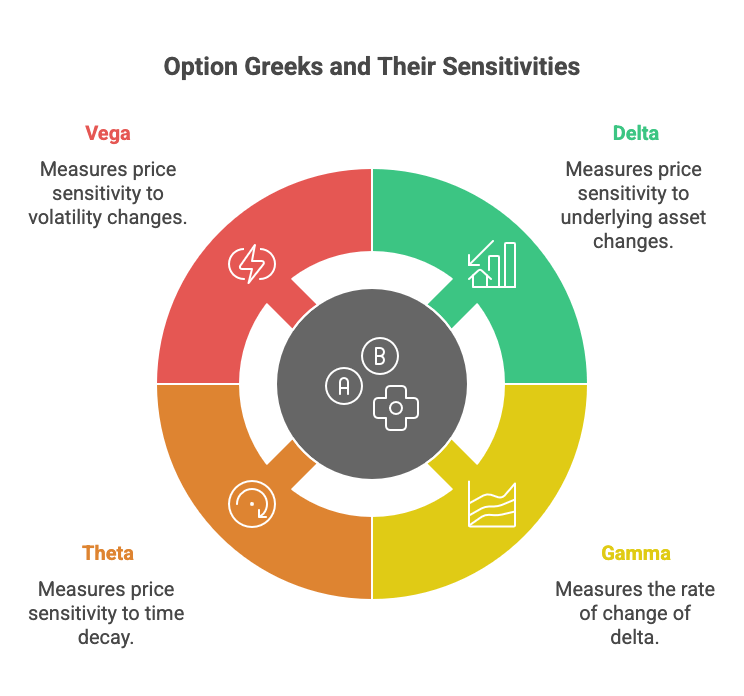

Introduction to Option Greeks: Measuring Sensitivity and Risk

The “Greeks” are a set of risk measures that describe the sensitivity of an option’s price to various factors:

- Delta: Sensitivity to Underlying Price Changes. Delta measures how much an option’s price is expected to change for a $1 change in the price of the underlying asset. Call options have positive deltas (0 to 1), while put options have negative deltas (0 to -1).

- Gamma: Sensitivity to Delta Changes. Gamma measures the rate of change of an option’s delta for a $1 change in the underlying asset’s price. It indicates how quickly delta will change as the underlying moves.

- Theta: Sensitivity to Time Decay. Theta measures how much an option’s price is expected to decrease each day due to time decay, assuming all other factors remain constant.

- Vega: Sensitivity to Implied Volatility Changes. Vega measures how much an option’s price is expected to change for a 1% change in implied volatility.

Understanding the Greeks is vital for managing the risk and potential reward of your options trading strategies.

Overview of Option Pricing Models and Their Use

- How Models Help Estimate Theoretical Value. Option pricing models, like the Black-Scholes model, use various inputs (underlying price, strike price, time to expiration, volatility, interest rates) to calculate a theoretical fair value for an option.

- The Black-Scholes Model and Its Components. While complex, this model provides a framework for understanding how different factors influence option prices. Traders use these models to identify potentially mispriced options.

Popular Options Trading Strategies for Different Market Views

One of the greatest strengths of options is their versatility. There are options trading strategies suitable for virtually any market outlook.

Choosing the Right Strategy for Your Market Outlook

Your forecast for the underlying asset’s price movement is the primary driver in selecting an appropriate strategy:

- Strategies for Bullish Markets: When you expect the price of the underlying asset to rise. Examples include buying call options, selling put options, or implementing bull call spreads.

- Strategies for Bearish Markets: When you expect the price of the underlying asset to fall. Examples include buying put options, selling call options, or implementing bear put spreads.

- Strategies for Neutral (Sideways) Markets: When you expect the price of the underlying asset to trade within a relatively narrow range. Examples include selling iron condors, short straddles/strangles (with caution), or covered calls.

- Strategies for Volatile Markets: When you expect a significant price move but are unsure of the direction. Examples include buying straddles or strangles.

Income Generation Strategies: Covered Calls and Naked Puts

These are popular options trading strategies for generating income:

- Covered Call Strategy: Writing Calls Against Owned Stock.

- How to Build a Covered Call Position: An investor who owns at least 100 shares of a stock sells (writes) call options on that stock.

- Potential Benefits (Income, Reducing Cost Basis) and Risks: The premium received from selling the call provides income and can lower the effective cost basis of the stock. The main risk is that if the stock price rises above the strike price, the shares may be “called away,” limiting upside profit on the stock.

- Naked Put Writing (Cash-Secured Puts): Selling Puts to Potentially Buy Stock.

- Using Naked Puts to Acquire Stock at a Discount: An investor sells a put option with the intention of buying the underlying stock if its price falls below the strike price. It’s “cash-secured” if the seller has enough cash set aside to buy the shares if assigned.

- Potential Benefits (Income) and Risks (Obligation to Buy): The seller receives a premium for selling the put. The risk is being obligated to buy the stock at the strike price, even if the market price has fallen further. This is a bullish-to-neutral strategy.

Spread Strategies: Defining Risk and Reward Potential

Spreads involve simultaneously buying and selling one or more options of the same class on the same underlying asset but with different strike prices or expiration dates.

- What is an Option Spread? Spreads can limit risk but also cap potential profit. They are a cornerstone of many advanced options trading strategies.

- Credit Spreads vs. Debit Spreads.

- Credit Spreads: You receive a net credit when establishing the position (e.g., bull put spread, bear call spread). The goal is for the options to expire worthless, allowing you to keep the credit.

- Debit Spreads: You pay a net debit to establish the position (e.g., bull call spread, bear put spread). The goal is for the spread to increase in value.

- Index Credit Spreads: An Aggressive Strategy with Limited Risk. Selling credit spreads on indexes can be a way to generate income with defined risk, often betting that the index will not move beyond certain levels.

- Rules for Using Index Credit Spreads. These typically involve selecting appropriate strike prices based on probability and managing the trade as expiration approaches.

Volatility Strategies: Profiting from Expected Price Swings

These strategies are used when a trader expects a large price move in the underlying asset but is uncertain about the direction.

- Straddle Strategy: Buying Both a Call and a Put at the Same Strike and Expiration.

- When to Use a Straddle: Typically employed before an earnings announcement, major news event, or when high volatility is anticipated.

- Potential Profit in Large Moves, Risk in Sideways Markets: The position profits if the underlying asset makes a significant move in either direction, enough to cover the cost of both options. If the price stays relatively stable, both options can expire worthless, resulting in a loss of the premium paid.

- Strangle Strategy: Buying Calls and Puts with Different (Out-of-the-Money) Strikes but Same Expiration.

- Strangle vs. Straddle Comparison: Strangles are generally cheaper to implement than straddles because they use OTM options. However, the underlying asset needs to make an even larger move for a strangle to be profitable.

Advanced Strategies: Ratio Writes, Diagonal Spreads, and More

As traders gain experience, they may explore more complex options trading strategies:

- Ratio Writes: Combining Long Stock with Excess Short Calls. For example, owning 100 shares and selling 2 (or more) call options. This increases income potential but also increases risk if the stock price rises significantly.

- Diagonal Spreads: Involve options with different strike prices and different expiration dates. These can be structured for various market outlooks and time horizons.

Essential Elements of Options Trading Success

Success in options trading isn’t just about knowing strategies; it’s about disciplined application, risk management, and continuous learning.

Developing Your Options Trading Plan

A well-defined trading plan is your roadmap to navigating the markets.

- Defining Your Goals (Income, Protection, Speculation). What do you want to achieve with options trading?

- Outlining Entry and Exit Criteria. When will you enter a trade, and under what conditions will you exit (for profit or to limit loss)?

- Incorporating Money Management Tactics. How much capital will you risk per trade? What is your maximum acceptable drawdown?

- The Importance of Writing Down Your Plan. A written plan helps maintain discipline and consistency.

Risk Management in Options Trading: Protecting Your Capital

Effective risk management is paramount in options trading.

- Calculating Maximum Profit and Loss. Before entering any trade, understand the best-case and worst-case scenarios. Many options trading strategies have defined risk.

- Setting Stop-Loss Orders (Use with Caution for Options). While common in stock trading, stop-loss orders on options can be tricky due to volatility and bid-ask spreads. Alternative exit strategies are often preferred.

- Hedging Existing Positions. Using options to protect other investments in your portfolio.

- Understanding and Managing Margin Risk. If trading on margin, be aware of the requirements and the potential for margin calls.

The Importance of Options Education and Practice

The options market is dynamic, and continuous learning is key.

- Continuous Learning is Key. Read books, take courses, and follow reputable market analysts.

- Start with Paper Trading (Simulated Trading). Most brokers offer paper trading accounts where you can practice options trading strategies with virtual money before risking real capital. This is an invaluable step.

- Reading and Utilizing Educational Resources. Many brokerage firms and financial websites offer extensive educational materials.

Analyzing Opportunities: Doing Your Homework and Finding an Edge

Successful traders look for an “edge”, a reason why a particular trade has a higher probability of success.

- Analyzing the Underlying Security. Understand the fundamentals and technicals of the stock or ETF you are trading options on.

- Looking for Options with a Statistical or Mathematical Advantage. This might involve analyzing implied volatility relative to historical volatility or identifying mispriced options.

- Identifying Undervalued and Overvalued Options. Based on your analysis and pricing models.

Discipline and Mindset: Avoiding Common Pitfalls

Psychology plays a huge role in trading success.

- Beware of Hype and “Secret” Systems. There are no guarantees in trading. Be skeptical of claims of easy profits.

- Focus on a Sound Game Plan, Not Just Predictions. Your plan should account for being wrong.

- Consistency and Patience Over “Hitting a Home Run”. Aim for consistent, manageable gains rather than trying to get rich quick.

Practical Aspects of Trading Options Online

Modern technology has made options trading accessible to individual investors.

Choosing an Online Brokerage and Trading Platform

Selecting the right broker is an important first step.

- What to Look for in an Options Trading Platform:

- Commissions and fees

- Quality of trading tools (charting, analysis, options chain)

- Execution speed and reliability

- Educational resources

- Customer support

- Range of tradable options

- Understanding Execution Quality. Look for brokers that offer good price improvement and minimize slippage.

Reading an Options Chain: Your Window into the Market

The options chain is where you’ll find all available option contracts for a particular underlying asset.

- Accessing and Interpreting Options Chain Data. Chains are typically organized by expiration date and then by strike price, showing calls on one side and puts on the other.

- Key Information Found in an Options Chain:

- Strike prices

- Expiration dates

- Bid and Ask prices for each contract

- Volume (number of contracts traded that day)

- Open Interest (total number of outstanding contracts)

- Implied Volatility

- Option Greeks (Delta, Gamma, Theta, Vega)

Executing Your Trade: Understanding Option Orders

Knowing how to place orders correctly is crucial.

- Buy to Open (BTO): To initiate a long option position (buying a call or a put).

- Sell to Open (STO): To initiate a short option position (selling/writing a call or a put).

- Buy to Close (BTC): To exit a short option position.

- Sell to Close (STC): To exit a long option position.

- Placing Limit Orders. It’s generally recommended to use limit orders for options to specify the maximum price you’re willing to pay (for buys) or the minimum price you’re willing to accept (for sells). This helps avoid unfavorable fills due to wide bid-ask spreads.

Understanding Margin Requirements for Options

- Margin for Buying vs. Writing Options.

- When buying options, the maximum risk is the premium paid, so typically, the full cost is debited from your account (no margin involved beyond having sufficient funds).

- When writing options (especially naked options or certain spreads), brokers will require margin to cover potential losses. Margin requirements vary based on the strategy, the broker, and the underlying asset’s volatility.

Investment Philosophy for Options Traders

Integrating options trading strategies into your overall investment approach requires careful consideration of your financial goals and risk tolerance.

Tailoring Strategies to Your Investment Profile

Not all options trading strategies are suitable for every investor.

- Options Strategies for Conservative Investors: Strategies like covered calls on dividend-paying stocks or buying protective puts can align with a more conservative approach.

- Aligning Option Trades with Your Overall Portfolio. Ensure your options trading activities complement, rather than conflict with, your broader investment objectives.

Setting Realistic Objectives and Long-Term Goals

- Options as Part of a Long-Term Investment Plan. Options can be used strategically over the long term for income, hedging, or controlled speculation, not just for short-term bets.

- Avoid Unrealistic Expectations. Consistent profitability in options trading takes time, education, and discipline.

Monitoring and Adjusting Your Positions

Options positions often require active management.

- Why Position Management is Crucial. Market conditions change, and your initial assumptions may prove incorrect. Being able to adjust or exit positions is key.

- Knowing When and How to Exit a Trade. This goes back to your trading plan. Have predefined rules for taking profits or cutting losses. This might involve rolling positions to different strike prices or expiration dates.

Frequently Asked Questions (FAQs) About Options Trading

- What are the best options trading strategies for beginners?

Beginners often start with buying calls or puts (for directional bets with defined risk), covered calls (if they own stock), or cash-secured puts (if they are willing to buy stock at a lower price). Simple debit spreads can also be a good starting point for learning about risk-defined strategies. - How can options be used to generate monthly income?

Strategies like selling covered calls or cash-secured puts are popular for income generation. Credit spreads (e.g., bull put spreads or bear call spreads) can also be used to collect premium, aiming for the options to expire worthless. - What is the difference between buying and writing (selling) options?

- Buying options: You pay a premium for the right (not obligation) to buy or sell the underlying asset. Your risk is limited to the premium paid. You profit if the option gains value.

- Writing (selling) options: You receive a premium and take on the obligation to buy or sell the underlying asset if the option is exercised by the buyer. Your profit is limited to the premium received, but your risk can be substantial (potentially unlimited for naked calls).

- How does implied volatility affect option prices?

Higher implied volatility (IV) generally leads to higher option premiums because it suggests a greater likelihood of large price swings in the underlying asset. Conversely, lower IV leads to lower premiums. Many options trading strategies aim to profit from changes in IV. - Is options trading risky?

Yes, options trading involves significant risk and is not suitable for all investors. While some strategies have defined risk (like buying options or defined-risk spreads), others (like selling naked options) can lead to losses exceeding the initial investment. It’s crucial to understand the risks of any strategy before implementing it. - What is a covered call strategy?

A covered call involves owning at least 100 shares of an underlying stock and selling (writing) call options on that stock. It’s a strategy used to generate income from the premium received. The risk is that your shares might be “called away” if the stock price rises above the call’s strike price, limiting your upside profit on the stock. - Can you lose more than your initial investment with options?

- If you buy options, the maximum you can lose is the premium you paid.

- If you sell (write) certain types of options, particularly naked calls or puts, your potential loss can be far greater than the premium received, and in the case of naked calls, theoretically unlimited. This is why understanding margin and risk management is critical for option sellers.

- How important is it to understand the Option Greeks?

Understanding the Option Greeks (Delta, Gamma, Theta, Vega, Rho) is very important for more advanced options traders. They help quantify how an option’s price is likely to react to changes in the underlying asset’s price, time decay, and volatility. For beginners, a basic understanding is helpful, but deep knowledge becomes more critical as you employ more complex options trading strategies.

Build Your Expertise in Options Trading

Mastering options trading strategies requires a dedicated commitment to education, meticulous planning, unwavering discipline, and a mindset geared towards continuous learning. By thoroughly understanding the fundamentals of how options work, the dynamics that influence their pricing, and the diverse array of strategic approaches available, you can effectively leverage options as powerful instruments for speculation, hedging against risk, or generating consistent income.

It’s crucial to remember that the world of options trading offers no “super secret” systems or guaranteed pathways to profit. Sustainable success is cultivated through the development of a sound, well-researched trading plan, the discipline to adhere to that plan even amidst market volatility, and the diligent application of effective risk management techniques.

Ready to explore the world of options trading strategies and unlock their potential? Begin your journey with a solid foundation of education. Practice your chosen strategies in a risk-free paper trading environment to build confidence and refine your approach. Formulate your personalized trading plan today. Consider consulting the many valuable resources available, such as those from the Options Industry Council (OIC) or reputable financial education platforms, to deepen your understanding and enhance your trading skills.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial advice. Options trading involves significant risk and is not suitable for all investors. Consult with a qualified financial advisor before making any investment decisions.

This website may utilize artificial intelligence to assist in the creation of content. This may include generating ideas, drafting sections, and aiding in the editing process. All content is reviewed and edited by us to ensure accuracy and quality.