The New Financial Frontier: How AI is Revolutionizing Trading and Investing

The world of finance is in the midst of a profound transformation. The once-iconic images of traders shouting orders on bustling exchange floors have been largely replaced by the silent, near-instantaneous operations of sophisticated computer systems. At the heart of this evolution is Artificial Intelligence (AI), a force that is democratizing access to powerful trading and investing strategies previously reserved for Wall Street’s elite institutions. For the modern investor, understanding this new frontier is no longer an option; it is a necessity. AI-powered tools are not just automating tasks; they are fundamentally changing how market opportunities are identified, analyzed, and acted upon. This guide serves as a comprehensive introduction to this new landscape, demystifying the core technologies and providing a clear roadmap for harnessing their potential.

What is Algorithmic Trading? A Simple Explanation for Beginners

At its most basic level, algorithmic trading, often called “algo trading”, is the use of a computer program to execute trades automatically based on a predefined set of rules or instructions. Think of it like a detailed recipe for baking a cake. The algorithm is the recipe, containing specific instructions. The ingredients are market data, such as stock prices, trading volume, and economic indicators. The computer acts as the baker, following the recipe’s instructions with perfect precision and speed, without getting distracted or emotional.

A simple, concrete example of an algorithmic trading rule would be: “Buy 100 shares of Company XYZ when its 50-day moving average crosses above its 200-day moving average”. This is a common trend-following strategy known as a “golden cross,” which technical analysts often interpret as a bullish signal. By programming this rule into a computer, a trader automates the process. The system monitors the market continuously and executes the trade the moment the condition is met, a task that would require constant vigilance if done manually. This automation provides two immediate advantages: speed and discipline. Trades are executed faster than any human could manage, and the strategy is followed consistently, removing the potential for human emotions like fear or greed to interfere with the trading plan.

The “Brain” Behind the Bots: Understanding Machine Learning and Neural Networks in Finance

While early algorithmic trading relied on simple, fixed rules, the true revolution in financial technology comes from a more advanced subset of AI: Machine Learning (ML).

Machine Learning (ML)

Machine learning is a field of AI where computer programs have the ability to learn from and adapt to new data without being explicitly reprogrammed. Instead of just following a static set of instructions, an ML model is trained on vast amounts of historical data to recognize patterns. A helpful analogy is a modern email spam filter. It isn’t programmed with a list of every possible spam keyword; instead, it learns to identify junk mail by analyzing thousands of examples of both spam and legitimate emails.

In finance, ML models are trained on immense historical datasets that can include stock prices, trading volumes, corporate earnings reports, and macroeconomic data. By analyzing this information, they can identify subtle, complex patterns that may indicate a higher probability of a future price movement. For example, an ML model might discover a previously unknown correlation between a rise in a specific commodity’s price and the subsequent performance of a niche technology stock, an insight that could easily be missed by human analysts.

Neural Networks

Neural networks represent an even more advanced form of machine learning, with a structure inspired by the interconnected neurons of the human brain. A neural network consists of layers of nodes, or “neurons,” that process information. The input layer receives the initial data (e.g., stock price, volume), which is then passed through one or more “hidden” layers that perform complex calculations, and finally to an output layer that produces the result (e.g., a signal to buy or sell).

The power of this layered structure is its ability to identify and model highly complex, non-linear relationships within the data. Financial markets are rarely straightforward or linear; they are chaotic systems influenced by a multitude of interconnected factors. Neural networks excel in this environment, uncovering deep patterns that simpler models cannot detect. However, it is crucial to address a common misconception: neural networks do not “predict the future” with certainty. They are not a crystal ball. Instead, they are sophisticated analytical tools that analyze historical data to identify high-probability trading opportunities. Their output is a probabilistic assessment, not a guarantee of future performance.

This evolution from simple, instruction-following algorithms to adaptive, pattern-learning systems marks the most significant shift in automated trading. Early algo trading was about executing a pre-written recipe with superior speed and discipline. Today’s AI-driven systems are about learning to create the recipe by analyzing the ingredients. This leap from automation to intelligence makes modern AI tools exponentially more powerful, as they can generate novel strategies and adapt to changing market conditions. However, this advancement also introduces new challenges, most notably the “black box” problem, where the intricate reasoning behind an AI’s decision can become opaque even to its creators, a critical risk that will be explored in a later section.

Your AI-Powered Toolkit: A Categorized Guide to Modern Investing Platforms

The landscape of AI-powered investing tools is vast and varied, catering to different goals, risk appetites, and levels of desired involvement. For a newcomer, the key to success is not finding the single “best” tool, but rather identifying the category of tool that best aligns with their personal investment philosophy. The ecosystem can be broken down into four primary categories, representing a spectrum of engagement from fully passive to hyper-active.

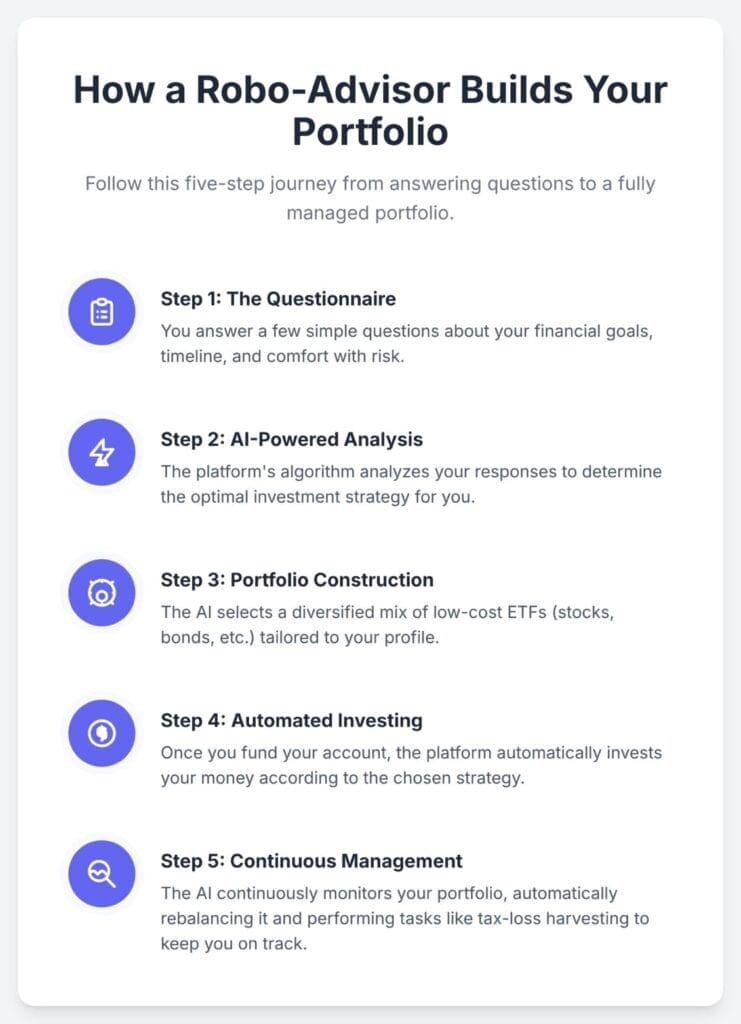

For the Hands-Off Investor: Robo-Advisors

Robo-advisors are digital platforms that use algorithms to provide fully automated investment portfolio management. The process is designed for simplicity. A new user typically answers a questionnaire about their financial goals (e.g., retirement, buying a home), time horizon, and tolerance for risk. Based on these answers, the platform’s algorithm constructs and manages a diversified portfolio, usually composed of low-cost exchange-traded funds (ETFs).

Leading platforms in this space, such as Wealthfront, Betterment, and Fidelity Go, have made professional-grade portfolio management highly accessible with low or no account minimums and management fees that are a fraction of what traditional human advisors charge. Their core functions include automated rebalancing to keep the portfolio aligned with its target asset allocation and tax-loss harvesting, a strategy that can help reduce tax liabilities. Academic studies have validated their effectiveness, showing that robo-advisors can significantly reduce portfolio risk, improve diversification by eliminating home bias, and increase overall risk-adjusted returns for investors who previously managed their own accounts. Furthermore, their ease of use has been shown to facilitate market participation among individuals who were previously hesitant to invest.

For the Active Researcher: AI Stock Screeners & Analysis Platforms

This category of tools acts as an AI-powered research assistant for the more hands-on investor. Traditional stock screeners allow users to filter for companies based on simple metrics like price-to-earnings (P/E) ratio or market capitalization. AI-powered screeners and analysis platforms go much further. They use machine learning to analyze thousands of data points, identify complex patterns, gauge market sentiment, and provide sophisticated, data-driven scores for individual stocks.

Platforms like WallStreetZen exemplify this approach by using an AI system to conduct a comprehensive, multi-factor analysis of each stock, distilling the results into an easy-to-understand “Zen Score”. Similarly, TrendSpider leverages AI to automate the time-consuming process of technical analysis, automatically identifying trendlines, chart patterns, and key support and resistance levels, thereby reducing manual error and saving traders hours of work. These tools empower investors to make more informed decisions by augmenting their own research with the analytical power of AI.

For the Strategic Trader: Automated Trading & Signal Generation Platforms

Distinct from robo-advisors that manage an entire long-term portfolio, automated trading platforms are designed for active traders who want to execute specific, often shorter-term, strategies. These tools do not typically provide holistic portfolio management; instead, they focus on generating actionable “buy” or “sell” signals or fully automating the execution of a user-defined strategy.

Trade Ideas is a prominent example, utilizing its proprietary AI engine, “Holly,” to run millions of backtests on various strategies every night. Each morning, it presents users with a handful of high-probability trade ideas, complete with entry and exit points, making it a favorite among active day traders. For those who lack the technical expertise or time to design their own strategies, platforms like StockHero offer a user-friendly, no-code solution. Users can deploy pre-built trading bots from a marketplace or create their own using a simple, guided interface, making algorithmic trading accessible to a much broader audience.

For the Market Pulse-Checker: Sentiment Analysis Tools

Market sentiment, the collective mood and attitude of investors toward a particular security or the market as a whole, is a powerful, yet often intangible, force. AI-powered sentiment analysis tools aim to quantify this force. They employ a branch of AI known as Natural Language Processing (NLP) to scan and interpret human language from millions of sources in real-time, including news articles, social media posts, earnings call transcripts, and regulatory filings.

By analyzing the tone and context of this text, these tools can assign a sentiment score (e.g., positive, negative, neutral) to a stock or market sector. This can provide a predictive edge, as shifts in public sentiment often precede significant price movements. Platforms like StockGeist specialize in this, aggregating and analyzing news and social media to give traders an early warning of changing market moods.

Ultimately, the choice of tool depends entirely on the investor’s personality and goals. The spectrum runs from the complete delegation of a robo-advisor to the high-engagement, high-frequency world of automated trading bots. A passive, long-term investor would be ill-served by a complex day-trading bot, just as an active trader would find a robo-advisor too restrictive. The first and most crucial step in leveraging AI is a moment of self-assessment: to decide not which tool is best, but which tool is the right fit for one’s own investment journey.

In-Depth Review: The Top 4 AI Trading Platforms of 2025

Navigating the crowded market of AI trading platforms can be daunting. To provide clarity, this section offers a detailed, comparative review of four leading platforms, each representing a distinct approach to AI-assisted investing. The analysis focuses on their core AI technology, ideal user profile, beginner-friendliness, and pricing structure to help investors make an informed decision.

Trade Ideas: The Leader in AI-Generated Day Trading Signals

- Core AI Technology: The heart of Trade Ideas is “Holly,” a proprietary AI engine. Each night, Holly stress-tests over 70 different strategies against the entire US stock market, running millions of simulated trades. This process identifies a small number of statistically robust, high-probability trading opportunities for the next day, complete with specific entry and exit points.

- Best For: Trade Ideas is unequivocally designed for active day traders and short-term swing traders. Its core value lies in providing a continuous stream of real-time, actionable trade signals, which is essential for those looking to capitalize on intraday volatility.

- Beginner-Friendliness: The platform has a significant learning curve. While its pre-configured channels and default settings offer a starting point, the sheer volume of data and customization options can be overwhelming for a true novice. The web-based version is generally considered more approachable for beginners than the comprehensive desktop application.

- Pricing: Trade Ideas operates on a subscription model. The Standard plan costs approximately $118 per month, while the Premium plan, which includes full access to the Holly AI and backtesting capabilities, is around $228 per month. Significant discounts are available for annual subscriptions.

TrendSpider: The Powerhouse of Automated Technical Analysis

- Core AI Technology: TrendSpider‘s AI focuses on automating the labor-intensive process of technical analysis. Its system automatically detects and draws trendlines, identifies over 150 candlestick patterns, and recognizes classic chart formations and Fibonacci levels with mathematical precision. Key features include the “Sidekick” AI assistant, which allows users to query charts using natural language, and the no-code AI Strategy Lab, where users can train custom machine learning models.

- Best For: This platform is ideal for technical traders of all levels who want to save time on manual charting, reduce human error and subjective bias in their analysis, and rigorously backtest their strategies without needing to write a single line of code.

- Beginner-Friendliness: While the platform is complex and feature-rich, its automation can be a powerful learning tool for beginners. By observing the patterns and levels that the AI identifies objectively, new traders can develop a better understanding of technical analysis principles. However, the platform’s depth requires a dedicated effort to master.

- Pricing: TrendSpider offers several subscription tiers. The Standard plan starts at around $82 per month, with the Premium and Enhanced plans costing approximately $137 and $183 per month, respectively. Each tier unlocks greater capabilities, such as deeper backtesting data, more active alerts, and additional workspaces.

StockHero: The Beginner’s Gateway to No-Code Algorithmic Trading

- Core AI Technology: StockHero‘s strength lies not in a single, complex AI engine, but in its user-friendly interface that democratizes algorithmic trading. Its primary “AI” feature is the ability for users to easily create, backtest, and deploy automated trading bots without any programming knowledge. A key component is the “Bots Marketplace,” which allows users to subscribe to and deploy pre-built strategies developed and vetted by experienced traders.

- Best For: StockHero is purpose-built for beginners, busy professionals, and anyone who is intrigued by algorithmic trading but lacks the time or technical skills to code their own strategies. It provides a gentle entry point into the world of automation.

- Beginner-Friendliness: This is the platform’s core advantage. It features a simple, three-step bot setup process, a risk-free “paper trading” mode for practice, and a “White-Glove Service” that offers a one-on-one personalized walkthrough for new users.

- Pricing: StockHero offers three main subscription plans. The “Lite” plan costs $29.99 per month for one active bot. The “Premium” plan at $49.99 per month allows for 15 active bots, and the “Professional” plan at $99.99 per month provides up to 50 active bots and access to higher-frequency trading intervals.

WallStreetZen: The Analyst’s Choice for AI-Powered Fundamental Research

- Core AI Technology: WallStreetZen‘s AI is focused on fundamental analysis rather than short-term trading signals. Its flagship feature is the “Zen Ratings” or “Zen Score,” an AI-driven system that performs a comprehensive, 115-factor review of every stock. It analyzes metrics across five key dimensions: Valuation, Financials, Forecast, Performance, and Dividend, and combines this quantitative analysis with insights from top-performing market analysts to generate a single, easy-to-digest score.

- Best For: This tool is best suited for long-term, fundamental investors who prioritize deep, data-driven research over technical charting. It helps users quickly assess the underlying health and long-term potential of a company.

- Beginner-Friendliness: The platform is exceptionally beginner-friendly. It excels at translating complex financial statements and analyst forecasts into simple, scannable scores and one-line explanations, making sophisticated fundamental analysis accessible to everyone.

- Pricing: WallStreetZen operates on a freemium model. Many core features are available for free, while a Premium subscription unlocks unlimited access to advanced data, analyst ratings, and screening capabilities.

| Tool Name | Core AI Technology | Best For (User Profile) | Beginner Friendliness (1-5 Scale) | Key Features | Pricing (Starting From) | Broker Integration |

| Trade Ideas | Proprietary AI “Holly” for nightly backtesting and signal generation | Active Day Traders & Swing Traders | 2/5 | Real-time trade signals, AI stock races, advanced scanners, backtesting | $118/month (Standard) | Yes (e.g., Interactive Brokers, E*TRADE) |

| TrendSpider | Automated pattern/trendline recognition, AI Sidekick assistant, no-code AI Strategy Lab | Technical Traders (All Levels) | 3/5 | Automated charting, multi-timeframe analysis, dynamic alerts, no-code backtesting | $82/month (Standard) | Yes (via third-party services like SignalStack) |

| StockHero | No-code bot builder and marketplace for pre-built trading strategies | Beginners & Busy Professionals | 5/5 | Bots marketplace, paper trading, simple setup, risk management tools, DCA bots | $29.99/month (Lite) | Yes (e.g., TradeStation, Webull, E*TRADE) |

| WallStreetZen | AI-driven “Zen Score” based on 115+ fundamental and technical factors | Long-Term Fundamental Investors | 5/5 | AI stock analysis, top analyst ratings, advanced stock screener, simple explanations | Freemium model | No (Analysis only) |

The Double-Edged Sword: Navigating the Promises and Perils of AI in Trading

Artificial Intelligence offers a tantalizing promise to investors: the ability to process information and execute trades with superhuman speed and discipline. However, this power is a double-edged sword. To invest responsibly in the age of AI, one must have a clear-eyed understanding of not only its profound advantages but also its significant and interconnected risks.

The Upside: Unlocking Superhuman Capabilities

The benefits of integrating AI into a trading strategy are substantial and can be categorized into four main areas:

- Speed and Efficiency: AI algorithms can analyze market data and execute trades in milliseconds, a speed far beyond the limits of human reaction time. In markets where prices change in an instant, this capability is critical for capturing opportunities and minimizing slippage (the difference between the expected price of a trade and the price at which the trade is actually executed).

- Massive Data Analysis: A single human analyst can only track a limited number of stocks and information sources. In contrast, AI systems can simultaneously process and analyze immense datasets in real-time, including market prices, corporate filings, global news feeds, and even social media sentiment. This allows them to uncover subtle patterns and opportunities that a human would inevitably miss.

- Emotionless Discipline: Two of the greatest enemies of the retail investor are fear and greed. These emotions often lead to irrational decisions, such as panic selling during a downturn or holding onto a losing position for too long. Algorithms are immune to these biases. They execute a predefined strategy with perfect discipline, ensuring that decisions are based on data and logic, not emotion.

- 24/7 Market Access: Financial markets are global and operate across different time zones. An AI-powered trading bot can monitor and trade these markets around the clock, capturing opportunities in Asian or European markets while a US-based investor is asleep. This provides constant vigilance and expands the range of potential trading opportunities.

The Risks & Limitations: A Clear-Eyed View

Despite the powerful advantages, the risks associated with AI in trading are equally significant and require careful consideration.

The “Black Box” Problem: When You Don’t Know Why the AI Made a Trade

As AI models, particularly deep neural networks, become more complex, their decision-making processes can become opaque. This is known as the “black box” problem. The AI may identify a highly profitable trading pattern, but the specific combination of variables and correlations it used to arrive at that conclusion can be so intricate that even its developers cannot fully explain the reasoning. This lack of transparency poses a major challenge. If a system starts losing money, it becomes incredibly difficult to diagnose the problem. Furthermore, relying on a strategy that one cannot understand requires a leap of faith that many investors are, quite rightly, unwilling to take.

Algorithmic Bias: How Past Prejudices Can Skew Future Predictions

Algorithmic bias occurs when an AI model produces systematically prejudiced outcomes because the historical data it was trained on reflects existing human biases. This is a classic “garbage in, garbage out” scenario. A stark example from the financial world was the Apple Card controversy, where the credit-scoring algorithm was found to offer significantly lower credit limits to women than to men with similar financial profiles, likely because it was trained on historical lending data that contained such biases. In trading, an AI trained exclusively on data from a decade-long bull market might learn to take on excessive risk, failing to recognize the warning signs of a market downturn because it has never “seen” one in its training data.

Data Security & Privacy: Protecting Your Assets and Information

Using an automated trading platform requires connecting it to a brokerage account, typically via an Application Programming Interface (API). This connection grants the platform the authority to execute trades on the user’s behalf. This creates a significant security risk: if the trading platform is compromised by a cyberattack, malicious actors could potentially gain control of the user’s account, leading to unauthorized trades and substantial financial loss.

Users must therefore practice rigorous cyber hygiene. This includes using strong, unique passwords for every platform, enabling two-factor authentication (2FA) whenever possible, being vigilant against phishing scams that try to steal login credentials, and never inputting sensitive personal or financial information into publicly available AI chatbots, as this data is often used for model training and can be exposed.

The Specter of Flash Crashes: Can AI Destabilize Markets?

A “flash crash” is an event where market prices plummet and then recover with extreme rapidity, often in a matter of minutes. The most famous example occurred on May 6, 2010, when the Dow Jones Industrial Average plunged nearly 1,000 points and then rebounded, temporarily wiping out almost $1 trillion in market value. Investigations revealed that the crash was triggered by a single large, automated sell order, which then set off a catastrophic chain reaction among thousands of other high-frequency trading (HFT) algorithms. As the initial sale pushed prices down, other algorithms, programmed to react to volatility and price momentum, began selling aggressively as well. This created a feedback loop that amplified the initial shock far beyond its fundamental significance, revealing how a market dominated by interconnected, high-speed automated systems can become fragile and susceptible to systemic risk.

These risks are not isolated issues; they are deeply interconnected. The opacity of a “black box” model makes it difficult to detect underlying algorithmic biases. An undetected bias can lead an algorithm to make irrational decisions under specific market conditions. When thousands of these opaque, potentially biased algorithms interact at microsecond speeds, their feedback loops can amplify a small market event into a full-blown flash crash. The lack of transparency then makes it nearly impossible for humans to intervene or for regulators to conduct a post-mortem, eroding trust and hindering the development of effective safeguards. The pursuit of more powerful AI, therefore, inherently requires a parallel pursuit of greater transparency, governance, and robust human oversight.

Your First Steps: A Practical Roadmap to AI-Assisted Investing

For those ready to explore the world of AI-assisted investing, a methodical and cautious approach is paramount. The allure of advanced technology can be powerful, but it should never replace a sound, well-considered financial strategy. This practical roadmap is designed to guide a beginner through the initial stages, emphasizing planning and education over impulsive action.

Step 1: Define Your Financial Goals and Risk Tolerance

Before exploring any platform or algorithm, the first and most critical step is introspection. AI is a tool, and like any tool, its usefulness depends on the task it’s applied to. An investor must first define that task by answering fundamental questions:

- What are the financial goals? Is the objective long-term growth for retirement, generating short-term income, or saving for a major purchase like a house?

- What is the time horizon? Is the investment timeline 30 years or 3 years? Shorter timelines generally call for less aggressive strategies.

- What is the personal risk tolerance? How would one react to a 20% drop in the portfolio’s value? An honest assessment of one’s comfort with volatility is essential for choosing an appropriate strategy and avoiding panic-driven decisions.

Step 2: Choose the Right Type of AI Tool for You

With clear goals in hand, the next step is to match those goals to the correct category of AI tool, as detailed in Section 2. Many beginners make the mistake of adopting a “solution-first, problem-second” mindset, drawn in by the hype of a complex tool that doesn’t fit their needs. This often leads to confusion, misuse, and financial loss. A simple self-assessment can prevent this:

- For the “Set It and Forget It” Investor: If the goal is long-term, diversified investing with minimal hands-on management, a Robo-Advisor is almost certainly the best starting point.

- For the “DIY Researcher”: If one enjoys researching individual stocks but wants an AI assistant to speed up the process and provide deeper insights, an AI Stock Screener & Analysis Platform is the right choice.

- For the “Aspiring Active Trader”: Only if one has a clear, specific, and tested trading strategy that they wish to automate should they consider an Automated Trading & Signal Generation Platform. This category carries the highest risk and requires the most knowledge.

Step 3: Understanding the Regulatory Environment (A Note on SEC & FINRA Oversight)

Investors should be aware that the AI in the finance space is not an unregulated “wild west.” While regulators like the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) have not yet issued a comprehensive set of new rules specifically for AI, they have made it clear that existing financial regulations apply fully to these new technologies.

Regulators are actively monitoring the industry for several key risks, including misleading claims about AI capabilities (a practice known as “AI washing”), the potential for algorithmic bias to lead to discriminatory outcomes, and cybersecurity vulnerabilities. This oversight provides a layer of protection for investors but also underscores the importance of choosing reputable, well-established platforms and approaching marketing claims with healthy skepticism.

Step 4: Start Small, Test, and Learn (The Importance of Paper Trading)

The final step before committing real capital is to test the chosen platform and strategy in a risk-free environment. It is highly inadvisable to begin with a large sum of money. Instead, one should start with a small amount that they can afford to lose as they navigate the learning curve.

Better yet, investors should take full advantage of “paper trading” or simulation modes, which are offered by many platforms, including StockHero and Trade Ideas. Paper trading allows users to deploy their strategies using virtual money in a live market environment. This provides an invaluable opportunity to:

- Learn the platform’s interface and features without financial risk.

- Validate whether a chosen strategy performs as expected in real market conditions.

- Gain confidence in the automated process before transitioning to a live-funded account.

By following this deliberate, step-by-step process, a new investor can approach AI-powered tools not as a magical solution but as a powerful supplement to a well-defined financial plan, dramatically increasing their chances of long-term success.

The Future Is Now: What’s Next for AI in Finance?

The integration of Artificial Intelligence into finance is still in its early stages, and the pace of innovation continues to accelerate. Looking ahead, the evolution of AI promises to reshape the investment landscape further, offering unprecedented levels of personalization while simultaneously reinforcing the indispensable role of human oversight and judgment.

The Rise of Generative AI: From Market Analysis to Hyper-Personalized Advice

The next wave of transformation is being driven by Generative AI, the technology behind models like ChatGPT. In finance, this technology is poised to evolve into sophisticated “copilots” that work alongside financial professionals. These AI assistants will be able to perform complex tasks such as drafting sections of financial reports, analyzing general ledger entries for anomalies, and generating multiple forecast scenarios based on different economic assumptions, dramatically increasing efficiency.

However, the path to widespread adoption is not without its challenges. A recent study from MIT revealed a significant gap between the hype surrounding Generative AI and its current real-world impact, finding that as many as 95% of business attempts to integrate the technology are failing to achieve meaningful revenue acceleration. This serves as a crucial reality check, highlighting that while the potential is immense, practical and reliable implementation requires overcoming significant hurdles in accuracy and data security.

The ultimate promise of this technology lies in hyper-personalization. As AI models become more adept at analyzing an individual’s complete financial picture in real-time, including their spending habits, income, investments, and stated goals, they will be able to deliver “segment-of-one” advice at a massive scale. This moves beyond the broad portfolio allocations of current robo-advisors to offer truly bespoke, dynamic financial guidance that was once the exclusive domain of private wealth managers serving the ultra-rich.

The Enduring Value of Human Insight in an AI-Driven World

Despite the remarkable advancements in AI, the future of successful investing is not one of complete automation. Instead, it is a future of symbiosis, where the computational power of machines augments the unique capabilities of human intelligence. AI excels at tasks that require speed, scale, and pattern recognition in vast datasets. It can execute a strategy with perfect, emotionless discipline and monitor markets tirelessly.

However, human judgment, intuition, and contextual understanding remain irreplaceable. AI models are trained on historical data, which makes them inherently vulnerable to “black swan” events, unprecedented crises for which the past offers no guide. In such moments, the ability of a human to reason, adapt, and apply qualitative judgment is paramount. Furthermore, ethical oversight and strategic direction are fundamentally human responsibilities.

The most successful investors of the future will be those who master this partnership. They will be the ones who can ask the right questions of the AI, critically evaluate its outputs, and set the overarching strategy. They will leverage AI not as an oracle to be blindly followed, but as an incredibly powerful tool to analyze, execute, and uncover insights at a scale and speed that were once unimaginable. In this new financial frontier, intelligence is not just artificial; it is a collaborative fusion of human and machine.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial advice. Investing in financial markets involves risk, including the possible loss of principal. Always conduct your own research and consider consulting with a qualified financial advisor before making any investment decisions.

This website may utilize artificial intelligence to assist in the creation of content. This may include generating ideas, drafting sections, and aiding in the editing process. All content is reviewed and edited by us to ensure accuracy and quality.