Foundations of Options Trading: Understanding the Building Blocks

A comprehensive understanding of options trading begins with a firm grasp of its fundamental concepts and terminology. Before exploring specific strategies, it is essential to define the core components of an option contract and the factors that influence its value. These building blocks are the bedrock upon which all options trading decisions and strategic applications are built. Misunderstanding these basics can lead to significant errors in judgment and potential financial loss.

Defining Key Options Terminology

The language of options trading includes several key terms that every trader must understand. These terms describe the rights, obligations, and characteristics of options contracts.

- Call Option: A call option is a financial contract that provides the buyer with the right, but not the obligation, to purchase an underlying asset (such as a stock) at a pre-agreed price, known as the strike price, on or before a specific date, which is the expiration date. Investors typically buy call options when they anticipate the price of the underlying asset will rise. The critical aspect for the buyer is the “right, not obligation,” which limits their maximum potential loss to the amount paid for the option, called the premium. Call options are fundamental to bullish strategies and can also be sold (written) as part of income-generating strategies.

- Put Option: Conversely, a put option grants the buyer the right, but not the obligation, to sell an underlying asset at the strike price on or before the expiration date. Investors generally purchase put options when they expect the price of the underlying asset to fall. Similar to call options, the buyer’s risk is limited to the premium paid. Put options are crucial for bearish strategies and for hedging purposes, such as protecting a long stock position (a strategy known as a protective put).

- Strike Price (Exercise Price): The strike price, or exercise price, is the fixed price at which the holder of an option can buy (in the case of a call) or sell (in the case of a put) the underlying asset if they choose to exercise the option. The relationship between the strike price and the current market price of the underlying asset determines whether an option is “in-the-money” (ITM), “at-the-money” (ATM), or “out-of-the-money” (OTM). This status directly influences the option’s value and its strategic application. For example, a conservative investor might choose a call option with a strike price at or below the current stock price, while a risk-tolerant trader might select a strike price above the current stock price.

- Expiration Date: The expiration date is the final day on which an option contract is valid. After this date, the option ceases to exist, and any rights associated with it are nullified. Options contracts can be American-style, which can be exercised at any time up to and including the expiration date, or European-style, which can only be exercised on the expiration date itself. The time remaining until expiration is a significant factor in an option’s price, primarily due to time decay. Options can have expirations ranging from a single day (0DTE or Zero Days to Expiration) to several months or even years (LEAPS).

- Premium: The premium is the price the option buyer pays to the option seller (writer) for the rights granted by the contract. For the buyer, the premium represents the maximum possible loss on the trade. For the seller, the premium is the maximum initial profit they can achieve if the option expires worthless. The premium is determined by several factors, including the option’s intrinsic value, its time value (which incorporates time to expiration and implied volatility), the underlying asset’s price, the strike price, and prevailing interest rates.

- Intrinsic Value: Intrinsic value represents the tangible value of an option if it were to be exercised immediately. For a call option, intrinsic value is the amount by which the underlying stock’s price is above the strike price (Stock Price – Strike Price). If the stock price is below the strike, the intrinsic value is zero. For a put option, intrinsic value is the amount by which the strike price is above the underlying stock’s price (Strike Price – Stock Price). If the stock price is above the strike, the intrinsic value is zero. An option that possesses intrinsic value is termed “in-the-money”.

- Time Value (Extrinsic Value) & Time Decay (Theta): Time value, also known as extrinsic value, is the component of an option’s premium that exceeds its intrinsic value. It reflects the possibility that the option will become profitable (or more profitable) before it expires. Time decay, quantified by the Greek letter Theta (Θ), is the erosion of this time value as the option approaches its expiration date. Options are often called “wasting assets” because their time value diminishes over time, eventually reaching zero at expiration. This decay accelerates as the expiration date gets closer, particularly for at-the-money options. Time decay is a critical consideration for both option buyers, who are negatively impacted by it, and option sellers, who can profit from it.

The value of an option is not an arbitrary figure but is derived from the interplay of these fundamental components. The premium paid for an option is a composite of its intrinsic value (if any) and its extrinsic or time value. The intrinsic value is a direct consequence of the current stock price relative to the option’s strike price. The time value, on the other hand, is significantly influenced by the duration remaining until the expiration date and the market’s expectation of future price swings, known as implied volatility. Thus, the choices a trader makes, selecting the underlying asset, the type of option (call or put), the strike price, and the expiration date, directly establish the initial cost (premium) and the subsequent risk-reward profile of the trade. For instance, an option that is far out-of-the-money (possessing no intrinsic value) and has very little time until expiration (minimal time value) will command a low premium, but this low cost is typically associated with a correspondingly low probability of the trade being profitable. A clear understanding of this causal relationship between an option’s characteristics and its price is more vital for a novice trader than simply memorizing isolated definitions.

Table 1: Options Trading Terminology Glossary

| Term | Definition | Significance in Trading |

| Call Option | A contract giving the buyer the right, not the obligation, to buy an underlying asset at the strike price by the expiration date. | Used for bullish bets or sold to generate income. Buyer’s risk is limited to the premium. |

| Put Option | A contract giving the buyer the right, not the obligation, to sell an underlying asset at the strike price by the expiration date. | Used for bearish bets or to hedge long stock positions. Buyer’s risk is limited to the premium. |

| Strike Price | The predetermined price at which the option can be exercised. | Key determinant of an option’s moneyness (ITM, ATM, OTM) and its intrinsic value. |

| Expiration Date | The date on which the option contract becomes invalid. | Defines the option’s lifespan; significantly impacts premium due to time decay. |

| Premium | The price paid by the buyer to the seller for the option contract. | Buyer’s maximum loss; seller’s maximum initial profit. Reflects intrinsic and time value. |

| Intrinsic Value | The amount by which an option is in-the-money. Zero for ATM or OTM options. | The “real” value of an option if exercised immediately. |

| Time Value | The portion of the premium exceeding intrinsic value, reflecting potential for future profit. | Represents the risk premium associated with time and volatility. Decreases as expiration approaches (time decay). |

| Time Decay (Θ) | The rate at which an option’s time value erodes as expiration nears. | A cost for option buyers and a potential profit source for option sellers. Accelerates closer to expiration. |

Understanding Option Greeks: Gauges of Risk and Reward

Option Greeks are a set of risk measures, named after Greek letters, that quantify an option’s sensitivity to various factors affecting its price. These include changes in the underlying asset’s price, the passage of time, and shifts in market volatility. A sound understanding of the Greeks is indispensable for effective options trading, as they provide crucial insights for strategy selection, risk management, and portfolio hedging.

- Delta (Δ): Sensitivity to Underlying Price

Delta measures how much an option’s price is expected to change for a $1 move in the price of the underlying asset. It ranges from 0 to 1 for call options and from 0 to -1 for put options. For example, a call option with a delta of 0.60 is expected to increase in price by $0.60 if the underlying stock rises by $1 (all else being equal). Conversely, a put option with a delta of -0.40 would be expected to increase by $0.40 if the stock falls by $1.

Delta also serves as an approximate indicator of the probability that an option will expire in-the-money. An at-the-money option typically has a delta around 0.50 (for calls) or -0.50 (for puts), suggesting roughly a 50% chance of expiring in-the-money. Deep in-the-money options have deltas closer to 1 (for calls) or -1 (for puts), meaning they behave more like the underlying stock itself, while far out-of-the-money options have deltas closer to 0. Delta is crucial for assessing directional exposure and for constructing delta-neutral hedging strategies. - Gamma (Γ): Rate of Change of Delta

Gamma measures the rate at which an option’s delta changes in response to a $1 move in the underlying asset’s price. It essentially indicates how quickly an option’s directional sensitivity (delta) will change. Gamma is highest for at-the-money options and for options nearing their expiration date.

Long option positions (both calls and puts) have positive gamma, meaning their delta becomes more favorable as the stock moves in the anticipated direction (delta increases for calls if the stock rises, becomes more negative for puts if the stock falls). Short option positions have negative gamma, which can be risky as delta moves against the trader if the stock price moves significantly. High gamma implies that delta is very sensitive to price changes, which can lead to rapid shifts in an option’s value, especially near expiration. - Theta (Θ): Sensitivity to Time Decay

Theta quantifies the rate at which an option’s value (specifically its time value component) erodes due to the passage of time, assuming all other factors remain constant. It is typically expressed as a negative number for long option positions, representing the dollar amount an option is expected to lose per day. For option sellers, theta works in their favor, as the options they’ve sold lose value over time.

Time decay is not linear; it accelerates as an option approaches its expiration date, particularly for at-the-money options, which have the most time value to lose. Understanding theta is vital for selecting appropriate expiration dates and for strategies that aim to profit from time decay, such as selling options. - Vega (V): Sensitivity to Implied Volatility

Vega measures an option’s price sensitivity to a 1% change in the implied volatility of the underlying asset. Implied volatility reflects the market’s expectation of future price swings in the underlying asset. An increase in implied volatility generally leads to an increase in the price of both call and put options, as there’s a greater perceived chance of a large price move making the option profitable. Conversely, a decrease in implied volatility tends to lower option premiums.

Vega is highest for at-the-money options and for options with longer times to expiration, as these options have more time value that can be influenced by changes in volatility expectations. Traders use vega to assess how changes in market sentiment about future volatility might impact their positions. Strategies designed to profit from expected changes in volatility (e.g., long straddles/strangles for rising IV, short straddles/strangles for falling IV) are heavily influenced by vega. - Rho (ρ): Sensitivity to Interest Rates

Rho measures how an option’s price is expected to change in response to a 1% change in the risk-free interest rate. Call options generally have positive rho, meaning their value tends to increase slightly as interest rates rise. Put options typically have negative rho, meaning their value tends to decrease as interest rates rise.

Rho is generally considered the least significant Greek for most retail options traders, especially those dealing with short-term options, because interest rate changes are usually small and slow-moving over the typical lifespan of an option contract. However, rho can be more relevant for long-term options, such as LEAPS (Long-term Equity Anticipation Securities).

The Option Greeks are not merely passive indicators of risk; they are dynamic tools that actively inform strategy selection and ongoing risk management. Each Greek highlights a specific sensitivity, to price direction (Delta), rate of change of directionality (Gamma), time erosion (Theta), or implied volatility (Vega). A trader’s outlook on the market, whether bullish, bearish, neutral, or anticipating high or low volatility, will naturally align with strategies that exhibit certain Greek profiles. For instance, if a trader expects a period of low volatility, they might select a strategy that profits from this, such as selling options (positive Theta, often negative Vega or Vega-neutral spreads like iron condors). Conversely, if high volatility is anticipated, a strategy with positive Vega, like a long straddle or strangle, would be more appropriate.

Thus, traders don’t just observe these Greek values; they proactively choose strategies based on the Greek exposures they desire. A trader wanting to make a directional bet will select a strategy with an appropriate Delta. One looking to profit from the passage of time will favor strategies that benefit from Theta decay. The interplay between these Greeks is also critical. For example, a delta-neutral trader might still face significant risk from Gamma if the underlying price moves sharply. Therefore, managing the overall Greek profile of a position or portfolio is a cornerstone of sophisticated options trading. The decision to buy or sell an option, and the choice of strike price and expiration, are all implicitly decisions about which Greek exposures the trader is willing to accept or wants to exploit.

Table 2: Summary of Option Greeks

| Greek Name | Symbol | What it Measures | Impact on Call Price (for a positive change in the factor) | Impact on Put Price (for a positive change in the factor) | Importance for Strategy Selection/ Risk Management |

| Delta | Δ | Sensitivity of option price to a $1 change in underlying asset price. | Increases (0 to 1) | Decreases (0 to -1, so value increases as stock falls) | Indicates directional exposure and probability of expiring ITM. Used for hedging and selecting strategies based on directional outlook. |

| Gamma | Γ | Rate of change of Delta to a $1 change in underlying asset price. | Positive for long calls | Positive for long puts | Measures stability of Delta. High Gamma means Delta changes rapidly. Important for dynamic hedging and managing risk of sharp price moves, especially near expiration. |

| Theta | Θ | Sensitivity of option price to the passage of one day (time decay). | Decreases (negative Theta for long options) | Decreases (negative Theta for long options) | Quantifies the “cost of waiting” for buyers and “profit from waiting” for sellers. Crucial for selecting expirations and for income strategies. |

| Vega | V | Sensitivity of option price to a 1% change in implied volatility. | Increases | Increases | Indicates exposure to changes in market’s expectation of future volatility. Key for volatility-based strategies (e.g., straddles, strangles). |

| Rho | ρ | Sensitivity of option price to a 1% change in risk-free interest rates. | Increases (generally small effect) | Decreases (generally small effect) | Least impactful for short-term options. More relevant for long-dated options (LEAPS). |

Core Options Trading Strategies Explored

Options trading offers a versatile toolkit for investors and traders, with strategies designed to suit a wide array of market outlooks and risk appetites. These strategies can be broadly categorized by their primary objectives, such as generating income, hedging existing positions, making directional bets with defined risk, capitalizing on market volatility, or profiting from neutral or range-bound market conditions.

Strategies for Income Generation

Income-generating strategies typically involve selling options to collect premiums. These are often employed when traders expect neutral to moderately directional price movements, allowing time decay and/or limited price movement to work in their favor.

1. Covered Calls

- Purpose: The primary aim of a covered call strategy is to generate additional income from an existing long stock holding. It can also serve to reduce the effective cost basis of the shares owned or to set a target selling price for the stock.

- Mechanics: This strategy involves owning at least 100 shares of an underlying stock and simultaneously selling (writing) one call option contract for every 100 shares owned. The call option sold is “covered” because the seller owns the underlying shares and can deliver them if the option is exercised by the buyer.

- Risk/Reward:

- Reward: The maximum profit is limited to the premium received from selling the call option plus any appreciation in the stock price up to the strike price of the call. If the stock price is at or above the strike price at expiration, the shares are likely to be “called away.”

- Risk: The primary risk is that the underlying stock price declines significantly. The premium received offers only a limited buffer against this loss. Additionally, if the stock price rises substantially above the call’s strike price, the investor forgoes any further profit on the stock beyond that strike price.

- Ideal Market Conditions: This strategy is best suited for a neutral to slightly bullish outlook on the underlying stock. The investor should be willing to sell their shares at the strike price if the option is exercised.

- Examples/Case Studies:

- An investor owns 100 shares of XYZ stock, purchased at $50 per share. They sell one XYZ call option with a strike price of $55, expiring in one month, for a premium of $2 per share ($200 total).

- If XYZ closes at or below $55 at expiration, the call expires worthless. The investor keeps the $200 premium and their 100 shares.

- If XYZ closes at $57 at expiration, the call is exercised. The investor sells their 100 shares at $55, realizing a $5 per share gain on the stock ($55 – $50) plus the $2 premium, for a total profit of $7 per share, or $700. They miss out on the stock’s appreciation above $55.

- If XYZ closes at $45, the call expires worthless. The investor keeps the $200 premium, but their stock is now worth $4500, resulting in an unrealized loss of $500 on the stock, partially offset by the $200 premium, for a net unrealized loss of $300.

- An investor buys 400 shares of XYZ at $39.30 and sells four March $40 strike calls at $0.90 each. The maximum profit per share is $1.60 ($0.70 stock appreciation to strike + $0.90 premium), and the breakeven point is $38.40 ($39.30 stock price – $0.90 premium).

- Example trade on SMH (VanEck Semiconductor ETF): buying 100 shares at $183.10 and selling a $192 strike call (37 days to expiration) for a $9.50 premium. The net cost was $17,360, with a breakeven at $173.60. If SMH is at $190 at expiration, it results in a $1,640 profit (option expires worthless, stock gains $690, premium kept $950). However, if SMH is at $210, where shares are called at $192, it results in a profit of $1,840 ($890 stock gain to strike + $950 premium).

- An investor owns 100 shares of XYZ stock, purchased at $50 per share. They sell one XYZ call option with a strike price of $55, expiring in one month, for a premium of $2 per share ($200 total).

- 2026 Outlook: Covered calls are a key strategy for 2026, particularly for generating income in markets that might exhibit volatility or in a higher interest rate environment where dividend-paying stocks (often used for covered calls) become more attractive.

2. Cash-Secured Puts

- Purpose: This strategy is used to generate income from selling put options, or with the intention of acquiring the underlying stock at a price effectively lower than its current market price.

- Mechanics: It involves selling (writing) a put option while simultaneously setting aside enough cash to purchase the underlying stock at the strike price if the option is assigned. This ensures the “put is secured by cash.”

- Risk/Reward:

- Reward: The maximum profit is limited to the premium received when selling the put option. This is achieved if the stock price stays at or above the strike price at expiration, causing the put to expire worthless.

- Risk: The risk is that the stock price falls below the strike price, obligating the seller to buy the stock at the strike price. The effective purchase price is the strike price minus the premium received. The maximum loss can be substantial if the stock price falls significantly, down to zero, less the initial premium.

- Ideal Market Conditions: A neutral to bullish outlook on the underlying stock is ideal. The investor must be willing to own the stock at the strike price if assigned.

- Example: An investor is willing to buy 100 shares of ABC stock at $47 per share, but it currently trades at $50. They sell one ABC put option with a $47 strike price, expiring in one month, for a premium of $2.00 per share ($200 total).

- If ABC closes at or above $47, the put expires worthless, and the investor keeps the $200 premium.

- If ABC closes at $45, the put is assigned. The investor buys 100 shares at $47 (costing $4,700). Their effective purchase price is $45 per share ($47 strike – $2 premium). The cash needed for this obligation was $4,700.

3. Credit Spreads (General Overview)

- Purpose: To generate a net credit (income) by simultaneously buying one option and selling another option of the same type (both calls or both puts) and same expiration, but with different strike prices. The strategy profits if the options expire favorably or if the spread narrows in value.

- Mechanics: A credit spread involves selling an option with a higher premium and buying an option with a lower premium. The difference between the premium received and the premium paid results in a net credit to the trader’s account upon opening the position.

- Risk/Reward:

- Reward: The maximum profit is limited to the net credit received at the initiation of the trade.

- Risk: The maximum loss is limited to the difference between the strike prices of the two options minus the net credit received.

- Ideal Market Conditions: The ideal conditions depend on the specific type of credit spread. Bull put spreads are for bullish to neutral markets, while bear call spreads are for bearish to neutral markets. Generally, these are used when expecting limited price movement or a specific directional bias that allows the short option component to expire worthless or decrease in value.

- Types: The two primary types of vertical credit spreads are the Bull Put Spread and the Bear Call Spread.

4. Bull Put Spread (Type of Credit Spread)

- Purpose: To profit from a neutral to moderately bullish outlook on the underlying asset, generating income through premium collection with defined risk.

- Mechanics: This strategy involves selling a put option at a higher strike price and simultaneously buying a put option at a lower strike price. Both puts have the same underlying asset and the same expiration date. The transaction results in a net credit because the premium received for the higher-strike short put is greater than the premium paid for the lower-strike long put.

- Risk/Reward:

- Reward: Limited to the net premium received when establishing the spread. This maximum profit is achieved if the price of the underlying asset is at or above the strike price of the short (higher-strike) put at expiration, causing both puts to expire worthless.

- Risk: Limited to the difference between the two strike prices minus the net credit received. This maximum loss is realized if the price of the underlying asset is at or below the strike price of the long (lower-strike) put at expiration.

- Ideal Market Conditions: Suitable for neutral to moderately bullish market conditions. The strategy benefits from time decay (theta) and from the stock price rising or staying above the short put’s strike price.

- Example: An investor believes XYZ stock, currently trading, will stay above $100 or rise. They implement a bull put spread by selling one XYZ 100 strike put for a premium of $3.20 and buying one XYZ 95 strike put for a premium of $1.30, both with the same expiration. The net credit received is $1.90 per share ($3.20 – $1.30).

- Max Profit: $1.90 per share (if XYZ is at or above $100 at expiration).

- Max Loss: ($100 – $95) – $1.90 = $3.10 per share (if XYZ is at or below $95 at expiration).

- Breakeven Point: $100 (short put strike) – $1.90 (net credit) = $98.10.

5. Bear Call Spread (Type of Credit Spread)

- Purpose: To profit from a neutral to moderately bearish outlook on the underlying asset, generating income through premium collection with defined risk.

- Mechanics: This strategy involves selling a call option at a lower strike price and simultaneously buying a call option at a higher strike price. Both calls have the same underlying asset and the same expiration date. This results in a net credit because the premium received for the lower-strike short call is greater than the premium paid for the higher-strike long call.

- Risk/Reward:

- Reward: Limited to the net premium received. This maximum profit is achieved if the price of the underlying asset is at or below the strike price of the short (lower-strike) call at expiration, causing both calls to expire worthless.

- Risk: Limited to the difference between the two strike prices minus the net credit received. This maximum loss is realized if the price of the underlying asset is at or above the strike price of the long (higher-strike) call at expiration.

- Ideal Market Conditions: Best suited for neutral to moderately bearish market conditions. The strategy benefits from time decay and from the stock price falling or staying below the short call’s strike price.

- Example: An investor believes Skyhigh Inc. stock, at a record high of $200, will drift lower. They initiate a bear call spread: Sell five $200 strike Skyhigh calls (expiring in one month) at $17 each, and buy five $210 strike Skyhigh calls (same expiration) at $12 each.

- Net Premium Received: ($17 – $12) x 5 contracts x 100 shares/contract = $2,500.

- Max Profit: $2,500 (if Skyhigh is at or below $200 at expiration).

- Max Loss: (($210 – $200) x 500 shares) – $2,500 = $5,000 – $2,500 = $2,500 (if Skyhigh is at or above $210 at expiration).

- Breakeven Point: $200 (short call strike) + ($2,500 / 500 shares) = $200 + $5 = $205.

6. Iron Condors

- Purpose: Designed to profit from low volatility when the underlying asset’s price is expected to remain within a specific, defined range until the options expire. It is a market-neutral strategy.

- Mechanics: An iron condor is constructed by simultaneously selling an out-of-the-money (OTM) put spread and an OTM call spread on the same underlying asset with the same expiration date. Specifically, it involves four legs:

- Selling an OTM put option.

- Buying a further OTM put option (lower strike than the sold put).

- Selling an OTM call option.

- Buying a further OTM call option (higher strike than the sold call).

The transaction results in a net credit, as the premiums received from selling the two spreads exceed the premiums paid for buying the protective wings.

- Risk/Reward:

- Reward: Limited to the net premium received when establishing the position. This maximum profit is achieved if the price of the underlying asset remains between the strike prices of the short put and the short call at expiration, causing all four options to expire worthless.

- Risk: Limited. The maximum loss occurs if the price of the underlying asset moves significantly beyond either the long put strike or the long call strike. It is calculated as the difference between the strikes of the call spread (or put spread, as they are typically of equal width) minus the net credit received.

- Ideal Market Conditions: Best suited for a neutral market outlook where low volatility is expected, and the underlying asset is anticipated to trade within a well-defined range. The strategy benefits from time decay (theta) as all options lose value over time if the price remains stable.

- Example: VOO is trading at $450. An investor expects low volatility and sets up an iron condor:

- Sell a $440 strike put for $2.

- Buy a $435 strike put for $1.

- Sell a $460 strike call for $2.

- Buy a $465 strike call for $1.

- Net Credit: ($2 + $2) – ($1 + $1) = $2 per share (or $200 for one set of contracts).

- Max Profit: $200 (if VOO is between $440 and $460 at expiration).

- Max Loss: Width of one spread ($5) – Net Credit ($2) = $3 per share (or $300). This occurs if VOO is below $435 or above $465 at expiration.

- Lower Breakeven: $440 (short put strike) – $2 (net credit) = $438.

- Upper Breakeven: $460 (short call strike) + $2 (net credit) = $462.

- 2026 Outlook: Iron condors are highlighted as a significant strategy for 2026, particularly effective in stable or range-bound markets. The use of AI-powered analytical tools may help in identifying suitable conditions for deploying iron condors by predicting volatility spikes or periods of calm.

Many income-generating strategies, such as covered calls, cash-secured puts, credit spreads, and iron condors, fundamentally rely on the sale of options. This approach allows traders to collect premium income upfront. A key factor benefiting these strategies is time decay, represented by the option Greek Theta. As options approach their expiration, their time value erodes, which is advantageous for the seller if the options expire out-of-the-money or can be bought back at a lower price. Consequently, these strategies often have a limited maximum profit (the net premium received) and a defined maximum risk.

However, there is an important interplay with volatility, represented by the Greek Vega. High implied volatility leads to higher option premiums, meaning sellers can collect more income when initiating a position. If implied volatility subsequently decreases (a “volatility crush”), it further benefits the option seller. Conversely, an unexpected increase in implied volatility can negatively impact a short option position, even if the price of the underlying asset remains within the desired range, because it increases the market value of the options sold. Strategies like the iron condor are explicitly designed for low-volatility environments. Therefore, successful income generation through option selling often depends not only on a correct forecast of price direction (or lack thereof) but also on an accurate assessment of current and future volatility. The anticipation for 2026 suggests that AI-driven tools might become increasingly important for identifying optimal entry and exit points for these strategies by analyzing volatility patterns.

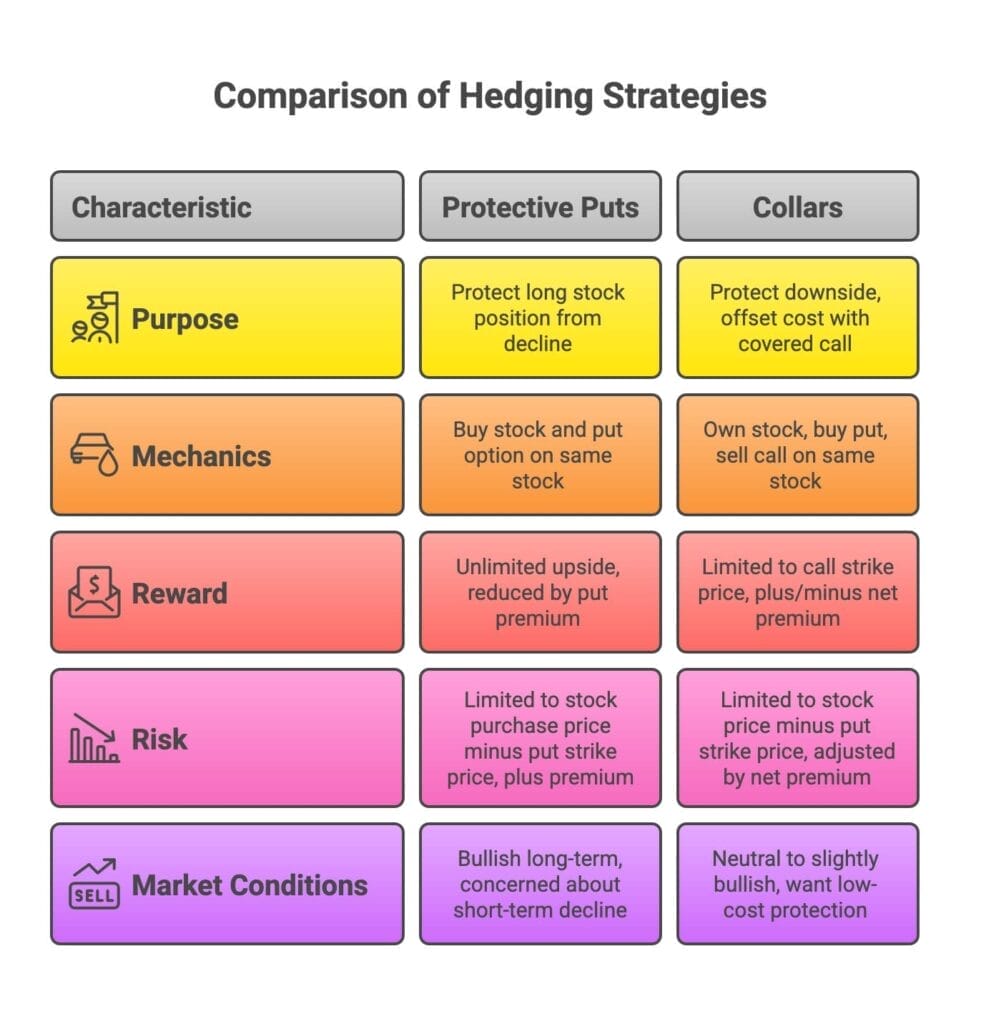

Strategies for Hedging (Risk Management)

Hedging strategies aim to reduce or offset potential losses in an existing investment position or an overall portfolio. Options are particularly well-suited for this purpose due to their flexibility.

1. Protective Puts (Married Puts)

- Purpose: A protective put is designed to safeguard an existing long stock position against a potential decline in its price, much like an insurance policy protects an asset. It allows the investor to limit downside risk while retaining the potential for upside gains if the stock price appreciates.

- Mechanics: This strategy involves holding (or simultaneously purchasing) shares of an underlying stock and buying a put option on the same stock, typically with a strike price at or slightly below the current stock price. If the stock and put are purchased concurrently, it’s often termed a “married put”. Each put contract generally corresponds to 100 shares of stock.

- Risk/Reward:

- Reward: The upside profit potential from the stock holding remains theoretically unlimited, though it is reduced by the cost (premium) of purchasing the put option.

- Risk: The maximum loss is limited. It is determined by the difference between the stock’s purchase price and the put option’s strike price, plus the premium paid for the put. If the stock price falls below the put’s strike price, the investor can exercise the put to sell the stock at the strike, thus establishing a floor for their loss.

- Ideal Market Conditions: This strategy is suitable for investors who are bullish on a stock’s long-term prospects but are concerned about potential short-term declines due to market uncertainty, an upcoming earnings report, or other potentially volatile events. It is used when an investor wishes to stay invested but wants to protect unrealized gains or limit potential losses.

- Examples/Case Studies:

- An investor owns 100 shares of GE stock purchased at $10, now trading at $20. To protect unrealized gains, the investor buys one GE put option with a $15 strike price for a premium of $0.75 per share ($75 total). If GE falls below $15, the investor can sell their shares at $15. The minimum profit locked in is ($15 strike – $10 purchase price – $0.75 premium) = $4.25 per share.

- An investor owns 100 shares of XYZ stock trading at $130. Worried about near-term news, they buy an XYZ put with a $120 strike (expiring in two months) for $2.65 per share. If XYZ drops to $115, the put option might increase in value to $7.50, partially offsetting the stock’s loss.

- In another scenario: owning XYZ at $62 and buying a $60 strike put for $1. If the stock drops to $50, the loss is $3 per share ($2 stock loss down to strike + $1 premium), compared to a $12 per share loss without the put.

- 2026 Outlook: Protective puts are considered an important strategy for 2026, given potential economic uncertainties and the consequent need for portfolio protection.

2. Collars

- Purpose: A collar strategy aims to protect an existing long stock position against significant downside risk while simultaneously offsetting the cost of this protection by selling a covered call, which also caps the potential upside profit. It’s often used to create a “range” within which the stock’s value can fluctuate with limited risk and limited reward.

- Mechanics: This strategy involves three components:

- Owning at least 100 shares of the underlying stock.

- Buying an out-of-the-money (OTM) put option (the protective put component).

- Selling an out-of-the-money (OTM) call option (the covered call component).

All options are on the same underlying stock and typically have the same expiration date. The premium received from selling the call helps to finance, or entirely cover, the cost of buying the put.

- Risk/Reward:

- Reward: The maximum profit is limited. It occurs if the stock price rises to the strike price of the short call. The profit would be the appreciation of the stock up to the call’s strike price, plus or minus the net premium paid or received from the options (if the call premium is greater than the put premium, there’s a net credit; otherwise, a net debit).

- Risk: The maximum loss is also limited. It occurs if the stock price falls to the strike price of the long put. The loss would be the depreciation of the stock down to the put’s strike price, adjusted by the net premium from the options.

- Ideal Market Conditions: This strategy is suitable for investors who are neutral to slightly bullish on their stock holding but want to protect against a significant price drop at a low cost (or even for a net credit) and are willing to forgo potential gains above the short call’s strike price.

- Example: An investor owns 100 shares of ABC stock purchased at $50. To create a collar, they:

- Buy one ABC put option with a $45 strike price for a premium of $1.00 per share (costing $100).

- Sell one ABC call option with a $55 strike price for a premium of $1.50 per share (receiving $150).

- Net credit received: $0.50 per share ($1.50 – $1.00).

- If ABC closes above $55, the shares are called away at $55. Profit = ($55 – $50 stock gain) + $0.50 net premium = $5.50 per share.

- If ABC closes below $45, the investor can sell shares at $45 via the put. Loss = ($50 – $45 stock loss) – $0.50 net premium = $4.50 per share.

- The stock is protected below $45, and profits are capped above $55.

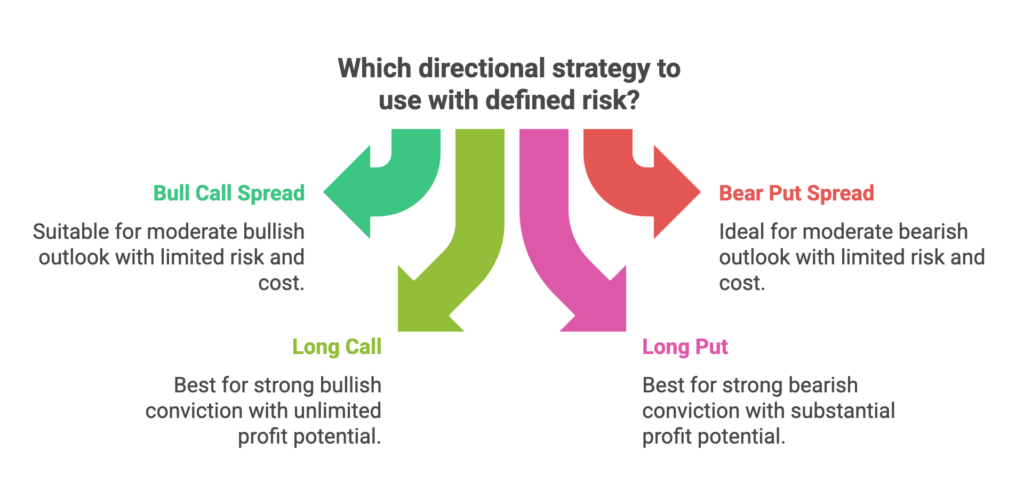

Directional Strategies with Defined Risk

Directional strategies are employed when traders have a specific expectation about the future direction of an asset’s price (bullish or bearish). Spread strategies are often used to define the risk and reward of these directional bets, making them more controlled than outright purchases or sales of options or stock.

1. Bull Call Spread (Debit Call Spread)

- Purpose: To profit from an anticipated moderate increase in the price of the underlying asset. This strategy is less costly and has lower risk than buying a call option outright, but it also has limited profit potential.

- Mechanics: A bull call spread is created by buying a call option at a specific (usually at-the-money or slightly in-the-money) strike price and simultaneously selling a call option with a higher (out-of-the-money) strike price. Both call options are on the same underlying asset and have the same expiration date. This transaction results in a net debit (cost) to the trader’s account, as the premium paid for the lower-strike call is typically higher than the premium received for the higher-strike call.

- Risk/Reward:

- Reward: The maximum profit is limited to the difference between the two strike prices minus the net debit paid to establish the spread. This profit is achieved if the price of the underlying asset is at or above the higher strike price (the short call) at expiration.

- Risk: The maximum loss is limited to the net debit paid for the spread. This occurs if the price of the underlying asset is at or below the lower strike price (the long call) at expiration, causing both options to expire worthless.

- Ideal Market Conditions: This strategy is best suited for a moderately bullish market outlook, where a gradual price rise up to the higher strike price is expected.

- Examples/Case Studies:

- A stock BBUX is trading at $37.50. A trader expects a rally to between $38 and $39. They buy a $38 strike call and sell a $39 strike call, both expiring in one month, for a net debit. If BBUX is at $39.50 at expiration, the trader makes a 100% return on the initial outlay (assuming specific premium values leading to this). If BBUX is at $37, the trader loses the entire net debit.

- An example: Buy 1 XYZ 100 call at $3.30 and sell 1 XYZ 105 call at $1.50. The net cost is $1.80. Max profit is ($105 – $100) – $1.80 = $3.20. Max risk is $1.80. The breakeven stock price at expiration is $100 + $1.80 = $101.80.

- Another example: Stock XYZ is at 50. Buy 50 CE for 3, sell 55 CE for 1. Net cost is 200 (for 100 shares). If the stock rises to 60, the profit is 300. If the stock stays below 50, the loss is 200.

2. Bear Put Spread (Debit Put Spread)

- Purpose: To profit from an anticipated moderate decrease in the price of the underlying asset. Like the bull call spread, it offers limited risk and a lower cost compared to buying a put option outright, but with capped profit potential.

- Mechanics: A bear put spread is constructed by buying a put option at a specific (usually at-the-money or slightly in-the-money) strike price and simultaneously selling a put option with a lower (out-of-the-money) strike price. Both put options are on the same underlying asset and have the same expiration date. This transaction results in a net debit (cost) because the premium paid for the higher-strike put is generally greater than the premium received for the lower-strike put.

- Risk/Reward:

- Reward: The maximum profit is limited to the difference between the two strike prices minus the net debit paid. This profit is achieved if the price of the underlying asset is at or below the lower strike price (the short put) at expiration.

- Risk: The maximum loss is limited to the net debit paid for the spread. This occurs if the price of the underlying asset is at or above the higher strike price (the long put) at expiration, causing both options to expire worthless.

- Ideal Market Conditions: This strategy is best suited for a moderately bearish market outlook, where a gradual price decline down to the lower strike price is expected.

- Examples/Case Studies:

- A stock is trading at $30. A trader buys one put option with a $35 strike for $4.75 and sells one put option with a $30 strike for $1.75. The net debit is $3.00 ($300). If the stock closes below $30 at expiration, the maximum profit is ($35 – $30) – $3.00 = $2.00 per share ($200).

- An example: Buy 1 XYZ 100 put at $3.20 and sell 1 XYZ 95 put at $1.30. Net cost is $1.90. Max profit is ($100 – $95) – $1.90 = $3.10. Max risk is $1.90. Breakeven is $100 – $1.90 = $98.10.

- Stock XYZ at $100. Buy $100 put for $6.00, sell $95 put for $3.50. Net debit $2.50. Max profit $2.50 ($5 spread width – $2.50 debit). Max loss $2.50. Breakeven $97.50.

3. Long Calls & Long Puts (Fundamental Directional Bets)

While often components of more complex spreads, buying calls or puts outright are the most fundamental directional strategies.

- Long Call:

- Purpose: To profit from an anticipated significant increase in the underlying stock’s price.

- Mechanics: Purchasing a call option, giving the right to buy the underlying at the strike price.

- Risk/Reward: Maximum loss is the premium paid for the call. Maximum profit is theoretically unlimited as the stock price can rise indefinitely.

- Ideal Conditions: Strong bullish conviction, expecting a substantial price increase that will more than offset the option premium and time decay.

- Long Put:

- Purpose: To profit from an anticipated significant decrease in the underlying stock’s price.

- Mechanics: Purchasing a put option, giving the right to sell the underlying at the strike price.

- Risk/Reward: Maximum loss is the premium paid for the put. Maximum profit is substantial (if the stock price falls to zero, profit is strike price minus premium).

- Ideal Conditions: Strong bearish conviction, expecting a substantial price decrease that will more than offset the option premium and time decay.

Directional spread strategies, such as bull call spreads and bear put spreads, result in a net debit (an upfront cost to implement), whereas their counterparts, bull put spreads and bear call spreads (often used for income), result in a net credit (upfront income). Debit spreads involve buying a relatively more expensive option (e.g., an at-the-money or in-the-money option) and selling a relatively cheaper option (e.g., an out-of-the-money option), leading to an initial cash outflow. The objective here is for the value of the purchased option to increase more than the value of the sold option, or for the spread between them to widen in a favorable direction.

Credit spreads, conversely, involve selling a more expensive option and buying a cheaper one, generating immediate income. The aim is for the options to expire worthless or for the spread to narrow or remain out-of-the-money, allowing the trader to keep the net premium.

The primary motivation for using spreads, both debit and credit, over simply buying a single call or put is often to reduce the initial cost and to define risk. By selling one option, the trader helps to finance the purchase of another, thereby lowering the capital required and capping the maximum potential loss. However, this risk limitation also inherently caps the maximum potential profit. The choice between a debit spread and a credit spread for a similar directional outlook (e.g., moderately bullish) hinges on several factors: the trader’s preference for paying an initial premium versus receiving one, their forecast for implied volatility (as credit spreads often benefit more from falling implied volatility or time decay), and their specific risk-reward objectives. For instance, a Bull Call Spread (a debit spread) will have a different profit and loss profile at expiration compared to a Bull Put Spread (a credit spread), even though both strategies are bullish in nature.

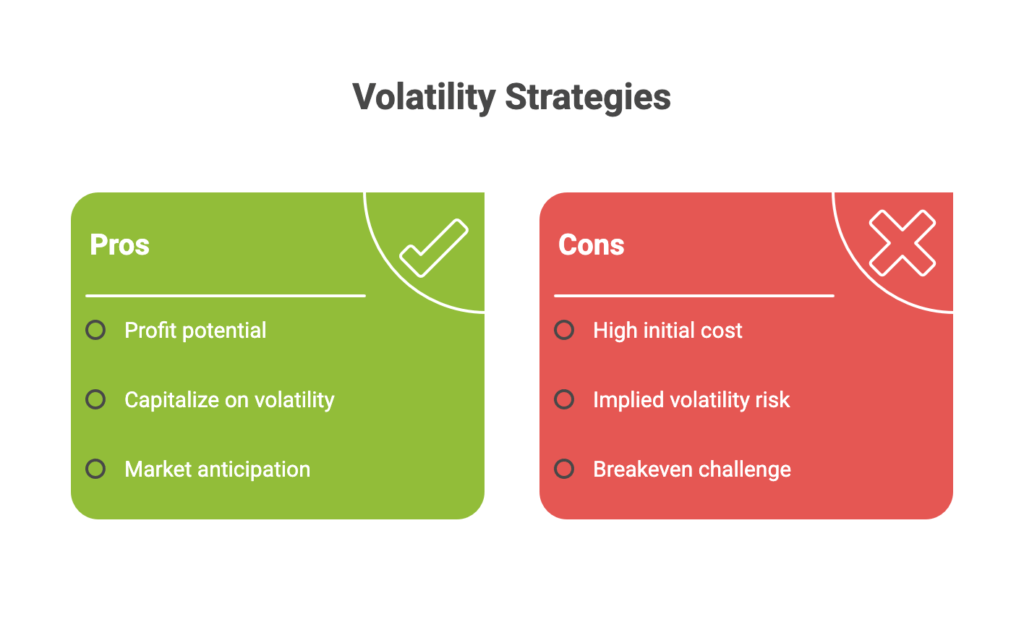

Strategies for Volatility

Volatility strategies are employed when a trader anticipates a significant price movement in the underlying asset but is uncertain about the direction (high volatility plays) or, conversely, expects minimal price movement (low volatility plays, often involving selling options).

1. Long Straddle

- Purpose: To profit from a substantial price movement in the underlying asset, regardless of whether the price moves up or down. It is a pure play on increased volatility.

- Mechanics: This strategy involves simultaneously buying one call option and one put option on the same underlying asset, with the same strike price (typically at-the-money or very close to it) and the same expiration date.

- Risk/Reward:

- Reward: The profit potential is theoretically unlimited if the stock price rises significantly, and substantial if the stock price falls significantly. The profit is the amount the stock moves beyond the breakeven points.

- Risk: The maximum loss is limited to the total premium paid for both the call and the put options, plus commissions. This occurs if the stock price is exactly at the strike price at expiration, causing both options to expire worthless.

- Ideal Market Conditions: This strategy is best used when a trader expects a sharp increase in volatility and a large price swing, often around events like earnings announcements, major news releases, or significant economic data publications, but is unsure of the direction of the move.

- Examples/Case Studies:

- A stock is trading at $100. An investor buys a $100 strike call for $5 and a $100 strike put for $5, both expiring in one month. The total premium (cost) is $10 per share. To profit, the stock must rise above $110 ($100 + $10) or fall below $90 ($100 – $10) by expiration.

- Earnings announcements and mergers are common scenarios for successful straddle trades due to the significant price swings they can cause.

- An example: Stock XYZ at $100. Buy 100 call for $3.30, buy 100 put for $3.20. Net cost $6.50. Upper breakeven $106.50, lower breakeven $93.50.

- 2026 Outlook: Straddles are highlighted as a strategy for 2026, fitting into the theme of trading anticipated market volatility, potentially driven by economic or geopolitical events.

2. Long Strangle

- Purpose: Similar to the long straddle, the long strangle aims to profit from a significant price movement in either direction (high volatility). However, it is typically less expensive to establish than a straddle because it uses out-of-the-money options.

- Mechanics: This strategy involves simultaneously buying an out-of-the-money (OTM) call option and an OTM put option on the same underlying asset, with the same expiration date but different strike prices. The call option’s strike price is above the current stock price, and the put option’s strike price is below the current stock price.

- Risk/Reward:

- Reward: The profit potential is theoretically unlimited on the upside and substantial on the downside, similar to a straddle.

- Risk: The maximum loss is limited to the total premium paid for both the call and the put options, plus commissions. However, because the options are OTM, the stock price needs to move more significantly than with a straddle to become profitable.

- Ideal Market Conditions: This strategy is best when a trader expects very high volatility and a very large price swing in the underlying asset. It is cheaper than a straddle, but the price must move further to reach the breakeven points.

- Examples/Case Studies:

- An example with Starbucks (SBUX): Buy a $52 strike call and a $48 strike put when the stock is around $50. The total cost was $5.85 ($585). Profit/loss scenarios are detailed based on the stock price at expiration.

- Stock ABC at $100. Buy a $105 strike call for $2 and a $95 strike put for $1.50. Total cost $3.50 ($350). Profit if stock moves above $108.50 ($105 + $3.50) or below $91.50 ($95 – $3.50).

- An example: Buy 1 XYZ 105 call at $1.50 and 1 XYZ 95 put at $1.30. Net cost $2.80. Upper breakeven $107.80, lower breakeven $92.20.

- 2026 Outlook: Strangles are also noted as relevant for 2026, especially for capitalizing on significant price swings in volatile assets, including cryptocurrencies.

Strategies like long straddles and long strangles are explicit bets on future volatility being greater than what is currently priced into the options by the market (implied volatility). These strategies involve purchasing two option contracts, meaning the trader incurs a debit equal to the sum of both premiums. This upfront cost represents the maximum potential loss for the trade. For the strategy to be profitable, the underlying asset’s price must move significantly, either up or down, enough to surpass the breakeven points, which are calculated by adding (for the upside) or subtracting (for the downside) the total premium from the respective strike prices.

The cost of these options, and thus the initial debit for the strategy, is heavily influenced by the prevailing level of implied volatility (IV). Higher IV translates to more expensive options because the market anticipates a greater likelihood of large price swings. When a trader buys a straddle or strangle, they are “buying volatility.” The ideal scenario is to implement such a strategy when IV is relatively low but is expected to rise due to an impending event (like an earnings report) or a shift in market sentiment. If IV is already very high, the options will be expensive, making it more challenging for the strategy to become profitable even if a substantial price move occurs.

A critical risk factor for these strategies is “IV crush.” Often, after a significant news event for which volatility was bid up, implied volatility can drop sharply, even if the stock price moved as anticipated. This decrease in IV reduces the value of the options and can turn a trade that was profitable based on price movement alone into a losing one, or reduce its profitability. Therefore, successful trading of straddles and strangles requires not just an accurate forecast of a large price move, but also an assessment that the anticipated move will be larger than what the market (via implied volatility) is already expecting. The 2026 outlook, which includes higher IV as a potential market feature, makes understanding this dynamic even more critical for traders considering these strategies.

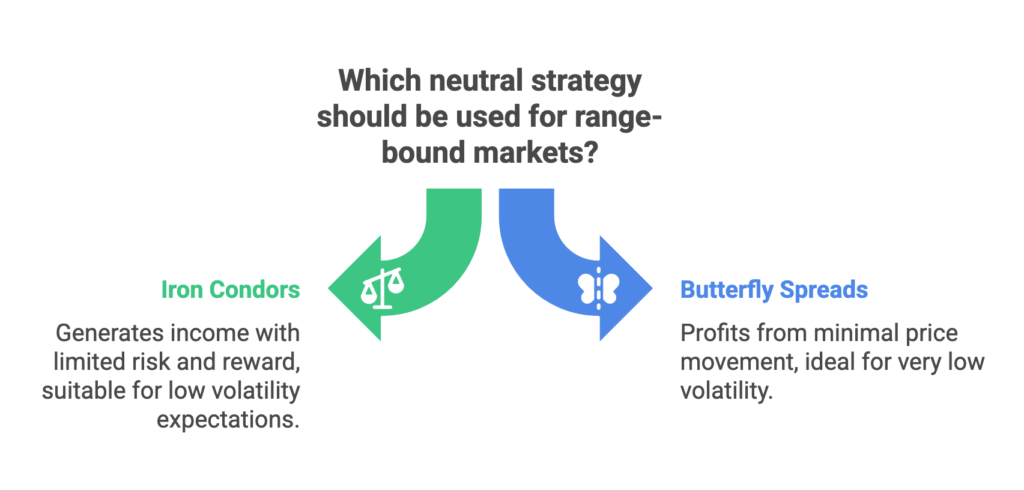

Neutral Strategies for Range-Bound Markets

Neutral strategies are designed for markets where the trader expects the price of the underlying asset to remain relatively stable or trade within a defined range. These strategies often profit from time decay or by defining a profitable zone where the stock price can fluctuate.

1. Iron Condors

- Purpose: To generate income by profiting from low volatility and time decay when the underlying asset is expected to trade within a specific price range until expiration.

- Mechanics: As previously detailed in the income generation section, an iron condor involves selling an out-of-the-money (OTM) put spread (selling a higher-strike put and buying a lower-strike put) and simultaneously selling an OTM call spread (selling a lower-strike call and buying a higher-strike call). All four options share the same expiration date. The strategy is established for a net credit.

- Risk/Reward:

- Reward: Limited to the net premium received when the position is opened. This is achieved if the underlying asset’s price remains between the strike prices of the short put and the short call at expiration.

- Risk: Limited to the difference between the strike prices of either the call spread or the put spread (assuming equal width) minus the net credit received. This maximum loss occurs if the underlying asset’s price moves significantly above the long call strike or below the long put strike.

- Ideal Market Conditions: A neutral market outlook with expectations of low implied volatility and the underlying asset trading in a range-bound fashion. The principles of range-bound trading, such as identifying support and resistance levels, are relevant here.

- Example: The VOO example previously cited under Income Generation illustrates the setup and P/L: VOO at $450, sell 440 put/buy 435 put, and sell 460 call/buy 465 call, for a net credit of $2. Max profit $200, max loss $300. Profitable if VOO stays between $438 and $462.

2. Butterfly Spreads

- Purpose: To profit from minimal price movement in the underlying asset, with the expectation that the stock price will be at or very near the middle strike price of the spread at expiration. This is a strategy for very low volatility.

- Mechanics (Long Call Butterfly): A common construction is the long call butterfly, which involves:

- Buying one call option with a lower strike price (often in-the-money or at-the-money).

- Selling two call options with a middle strike price (typically at-the-money).

- Buying one call option with a higher strike price (typically out-of-the-money).

All options have the same expiration date, and the strike prices are equidistant (e.g., $90, $100, $110). This setup results in a net debit. A long put butterfly can be constructed similarly using puts.

- Risk/Reward:

- Reward: Limited. The maximum profit is achieved if the underlying asset’s price is exactly at the middle strike price at expiration. It is calculated as the difference between the middle strike and the lower strike (or higher strike and middle strike), minus the net debit paid.

- Risk: Limited to the net debit paid to establish the spread. This maximum loss occurs if the stock price is at or below the lowest strike price or at or above the highest strike price at expiration.

- Ideal Market Conditions: Very low expected volatility, with a strong conviction that the stock price will “pin” to the middle strike price at expiration.

- Example: Stock XYZ is trading at $100. A trader establishes a long call butterfly:

- Buy 1 XYZ January 90 call for $5.00.

- Sell 2 XYZ January 100 calls at $2.50 each (total credit $5.00).

- Buy 1 XYZ January 110 call for $1.00.

- Net Debit: $5.00 (long 90 call) – $5.00 (short 100 calls) + $1.00 (long 110 call) = $1.00 per share.

- Max Profit: If XYZ is at $100 at expiration, the 90 call is worth $10, the 100 calls expire worthless, and the 110 call expires worthless. Profit = $10 (value of 90 call) – $1.00 (net debit) = $9.00 per share.

- Max Loss: $1.00 per share (if XYZ is below $90 or above $110 at expiration).

- Another example: Buy 1 Jan 45 call @ $7, sell 2 Jan 50 calls @ $2.50 each, buy 1 Jan 55 call @ $0.50. Net debit $2.50. Max profit if stock at $50 is ($50-$45) – $2.50 = $2.50.

Advanced Strategies (Brief Overview)

Advanced options strategies often involve more intricate setups, potentially combining different types of options, multiple legs, or varying expiration dates. These require a deeper understanding of options mechanics, the interplay of Greeks, and active management.

1. Calendar Spreads (Time Spreads / Horizontal Spreads)

- Purpose: To profit primarily from the differential rate of time decay (theta) between a short-term option and a long-term option, or from changes in implied volatility. Calendar spreads are typically directionally neutral in the short term.

- Mechanics: A standard calendar spread involves selling a shorter-term option and buying a longer-term option, with both options typically having the same strike price (usually at-the-money or slightly out-of-the-money). This can be done with either call options (long call calendar spread) or put options (long put calendar spread). The trade is usually established for a net debit.

- Risk/Reward (Long Calendar Spread):

- Reward: The maximum profit is typically achieved if the price of the underlying asset is at the strike price of the options when the short-term option expires. Profit can also be generated if implied volatility increases, as longer-dated options are more sensitive to vega.

- Risk: Limited to the net debit paid to establish the spread. This occurs if the underlying price moves significantly away from the strike price, causing both options to lose value, or if implied volatility decreases sharply.

- Ideal Market Conditions: Low volatility is expected in the near term, with the underlying price anticipated to stay close to the strike price of the options. Alternatively, the strategy can be used if an increase in implied volatility is expected. The strategy aims to benefit from the faster time decay of the short-term option sold compared to the slower decay of the longer-term option bought.

- 2026 Outlook: Calendar spreads are noted as a strategy for 2026, potentially useful in uncertain macroeconomic conditions where profiting from time decay or volatility shifts might be advantageous.

2. Diagonal Spreads

- Purpose: Diagonal spreads combine features of both vertical spreads (different strike prices) and calendar spreads (different expiration dates). They allow traders to establish a directional bias (bullish or bearish) while also aiming to benefit from time decay and/or changes in implied volatility.

- Mechanics: This strategy involves buying an option with a longer expiration date and selling an option with a shorter expiration date, where the two options have different strike prices. They can be constructed using calls or puts to create bullish or bearish positions. For example, a bullish long call diagonal spread involves buying a longer-term, lower-strike call and selling a shorter-term, higher-strike call.

- Risk/Reward: The risk and reward profiles of diagonal spreads are complex and vary significantly based on the specific strikes and expirations chosen. Long diagonal spreads are generally established for a net debit, and their maximum loss is typically this net debit. Short diagonal spreads are established for a net credit, with maximum profit limited to this credit, but potentially larger risks. The profit potential depends on the price movement of the underlying relative to the chosen strikes and the impact of time decay on the short-dated option.

- Ideal Market Conditions: The ideal conditions depend on the specific construction (bullish or bearish). The strategy aims to profit from a favorable directional move in the underlying asset, combined with the positive effect of the short-dated option decaying faster than the long-dated option.

- Example: A bullish long call diagonal spread could involve purchasing one December $20 strike call option and simultaneously selling one April $25 strike call option on the same underlying asset.

The progression from simple single-leg options (like buying a call or put) to multi-leg spreads (such as vertical spreads, iron condors, and butterfly spreads) and then to time-based spreads (like calendars and diagonals) reflects an increasing level of complexity in options trading. Single-leg options offer straightforward directional bets but can be costly for buyers or carry undefined risk for naked sellers. Vertical spreads, like bull call spreads or bear put spreads, are introduced to define this risk and reduce the initial capital outlay by selling a further out-of-the-money option; this, however, also caps the maximum profit.

More advanced strategies, such as iron condors and butterfly spreads, combine multiple vertical spreads to create positions tailored for range-bound markets or specific volatility expectations, further refining the risk and reward parameters. Calendar and diagonal spreads add another dimension by utilizing options with different expiration dates, aiming to capitalize on the differential rates of time decay (Theta) and shifts in implied volatility (Vega) across these timeframes.

This evolution in strategy complexity allows traders to express more nuanced market views and achieve more precise risk/reward profiles. However, it’s important to recognize that increased complexity often comes with higher transaction costs due to multiple legs, potentially wider bid-ask spreads for less liquid strategies, and more intricate profit and loss diagrams that require careful analysis. The choice of strategy should always align with the trader’s skill level, market outlook, and risk tolerance; complexity for its own sake does not guarantee better results.

Table 3: Comparative Table of Key Options Strategies

| Strategy Name | Market Outlook | Primary Purpose | Typical Construction | Max Risk | Max Reward | Complexity | Key Benefit | Key Risk |

| Covered Call | Neutral to Slightly Bullish | Income | Own Stock + Sell Call | Stock Price – Premium Received (Substantial) | Premium + (Strike – Stock Price) (Limited) | Beginner | Generates income from stock holdings, reduces cost basis. | Caps upside stock profit, stock can still fall significantly. |

| Protective Put | Bullish (with hedge) | Hedge | Own Stock + Buy Put | (Stock Price – Strike) + Premium (Limited) | Unlimited (Stock Growth – Premium) | Beginner | Limits downside risk on stock. | Cost of put premium reduces profits or increases losses. |

| Bull Call Spread | Moderately Bullish | Directional | Buy Lower Strike Call + Sell Higher Strike Call (Net Debit) | Net Debit Paid (Limited) | (Strike Diff – Net Debit) (Limited) | Intermediate | Lower cost & risk than long call, profits from moderate rise. | Profit capped if stock rises significantly. |

| Bear Put Spread | Moderately Bearish | Directional | Buy Higher Strike Put + Sell Lower Strike Put (Net Debit) | Net Debit Paid (Limited) | (Strike Diff – Net Debit) (Limited) | Intermediate | Lower cost & risk than long put, profits from moderate fall. | Profit capped if stock falls significantly. |

| Bull Put Spread | Neutral to Moderately Bullish | Income / Directional | Sell Higher Strike Put + Buy Lower Strike Put (Net Credit) | (Strike Diff – Net Credit) (Limited) | Net Credit Received (Limited) | Intermediate | Generates income, profits from rising/stable prices. | Max loss can be greater than max profit. |

| Bear Call Spread | Neutral to Moderately Bearish | Income / Directional | Sell Lower Strike Call + Buy Higher Strike Call (Net Credit) | (Strike Diff – Net Credit) (Limited) | Net Credit Received (Limited) | Intermediate | Generates income, profits from falling/stable prices. | Max loss can be greater than max profit. |

| Long Straddle | High Volatility Expected | Volatility | Buy ATM Call + Buy ATM Put (Same Strike & Expiry) | Total Premium Paid (Limited) | Unlimited (Up/Down) | Intermediate | Profits from large price move in either direction. | Requires significant price move to profit; high time decay. |

| Long Strangle | High Volatility Expected | Volatility | Buy OTM Call + Buy OTM Put (Different Strikes, Same Expiry) | Total Premium Paid (Limited) | Unlimited (Up/Down) | Intermediate | Cheaper than straddle, profits from very large price move. | Requires even larger price move than straddle; high time decay. |

| Iron Condor | Neutral (Range-Bound) | Income / Neutral | Sell OTM Put Spread + Sell OTM Call Spread (Net Credit) | (Spread Width – Net Credit) (Limited) | Net Credit Received (Limited) | Advanced | Profits if price stays in range, benefits from time decay. | Large loss if price moves beyond range. |

| Butterfly Spread | Very Low Volatility (Neutral) | Neutral | e.g., Buy ITM Call, Sell 2 ATM Calls, Buy OTM Call (Net Debit) | Net Debit Paid (Limited) | (Middle Strike – Lower Strike – Net Debit) (Limited) | Advanced | Profits from stock pinning at middle strike; defined risk. | Requires precise stock movement; low probability of max profit. |

| Calendar Spread | Neutral (Short-Term) | Time Decay/Vol | Sell Short-Term Option + Buy Long-Term Option (Same Strike, Net Debit) | Net Debit Paid (Limited) | Depends on price at short-term expiry & IV (Potentially High) | Advanced | Profits from time decay differential and/or IV increase. | Sensitive to IV changes; price must be near strike at front expiry. |

Mastering Options Trading: Risk Management & Best Practices

While understanding various options strategies is crucial, long-term success in options trading hinges more critically on robust risk management and disciplined trading practices. Options, by their nature, can involve leverage and complex risk profiles, making it imperative for traders to be aware of common pitfalls and to implement sound techniques to protect their capital and make informed decisions.

Common Pitfalls in Options Trading and How to Avoid Them

Even experienced traders can fall prey to common mistakes. Recognizing these pitfalls is the first step toward avoiding them.

- Ignoring the Basics / Lack of Preparation: A frequent error, especially among newcomers, is diving into options trading without a solid understanding of fundamental concepts like strike prices, premiums, intrinsic value, time decay (theta), and implied volatility. This lack of foundational knowledge is akin to navigating complex terrain without a map.

- Avoidance: Dedicate sufficient time to education before risking capital. Utilize reputable resources such as those provided by Investopedia, the CBOE Options Institute, and FINRA to build a strong understanding of how options work, how they are priced, and the basic mechanics of trading.

- Overleveraging Positions: The leverage inherent in options can amplify gains, but it equally magnifies losses. Many beginners, and even some experienced traders, make the mistake of committing too large a portion of their trading capital to a single trade or a small number of trades.

- Avoidance: Implement strict position sizing rules. A common guideline is to risk no more than a small percentage (e.g., 2-5%) of total trading capital on any individual trade. Starting with smaller position sizes allows traders to gain experience without jeopardizing their entire account.

- Not Considering Time Decay (Theta): Options are wasting assets; their time value erodes as they approach expiration. Many traders underestimate the impact of theta, holding onto long option positions for too long, only to see profits diminish or losses mount, even if their directional view was correct.

- Avoidance: Actively monitor the theta of options positions. Understand that time decay accelerates, especially in the last 30-45 days before expiration. For long option strategies, ensure the expected price move is significant enough and timely enough to overcome theta. Consider strategies that benefit from time decay, such as selling options, if appropriate for the market outlook.

- Neglecting Volatility (Implied and Historical): Implied volatility (IV) is a critical component of an option’s premium. Buying options when IV is excessively high means paying an inflated price, making it harder to profit. Conversely, selling options when IV is very low may not offer sufficient premium to compensate for the risk.

- Avoidance: Always assess both implied volatility (e.g., by checking the VIX for broad market options or IV for individual stocks) and historical volatility (HV) before entering a trade. If IV is unusually high, be cautious with buying premium or consider strategies that profit from a decrease in volatility (e.g., short spreads). If IV is very low, be aware that buying options might be cheaper, but a rise in IV could be beneficial.

- Chasing the Cheapest Options (Far OTM): Far out-of-the-money (OTM) options are inexpensive for a reason: they have a very low probability of expiring in-the-money. Treating these options like lottery tickets is a common path to consistent small losses that can accumulate over time.

- Avoidance: Focus on options with a reasonable probability of success, typically those closer to the current stock price (at-the-money or slightly out-of-the-money). While they cost more, the higher likelihood of a profitable outcome often justifies the expense.

- Lack of a Clear Strategy / Trading Plan: Trading based on intuition, rumors, or without clearly defined objectives, entry signals, exit rules (for profits and losses), and strategy selection criteria is a recipe for inconsistent results and emotional decision-making.

- Avoidance: Before any trade, develop a comprehensive trading plan. This plan should articulate the market outlook, the chosen options strategy that aligns with that outlook, specific entry and exit points (profit targets and stop-loss levels), and position size.

- Ignoring Risk Management / Not Using Stop-Losses (or equivalent risk controls): Failing to define the maximum acceptable loss for a trade or neglecting to use risk-limiting mechanisms is a critical error.

- Avoidance: Risk management should be paramount. Always determine the maximum risk before initiating a trade. While traditional stop-loss orders can be problematic for options due to their volatility and bid-ask spreads, risk can be managed by choosing defined-risk strategies (like spreads), by actively monitoring and closing positions when risk limits are approached, or by using hedging techniques.

- Emotional Trading (Fear and Greed): Fear can lead to exiting winning trades too early or holding onto losers too long in the hope of a turnaround. Greed can result in overtrading, excessive risk-taking, or failing to take profits when objectives are met.

- Avoidance: Adherence to a well-defined trading plan is the best defense against emotional trading. Maintain discipline, avoid making decisions based on momentary market fluctuations, and cultivate emotional detachment from individual trades.

- Misunderstanding Assignment Risk: Sellers of options (writers) face the risk of being assigned, meaning they are obligated to fulfill the contract—sell stock for calls or buy stock for puts. This can happen at any time for American-style options, and the risk is often higher for in-the-money options, especially around ex-dividend dates.

- Avoidance: Thoroughly understand the mechanics of option assignment and the circumstances under which it is most likely. Actively manage short option positions, particularly as expiration approaches or before ex-dividend dates. Be prepared for the financial implications of assignment.

- Focusing Only on Expiration Graphs (Ignoring T+0 Line): Many options diagrams show profit and loss only at expiration. However, the value of an option position changes continuously based on movements in the underlying price, time decay, and volatility. Ignoring the current P&L (often represented by a T+0 line) can lead to misjudging the position’s status.

- Avoidance: Pay attention to the T+0 line and understand how the Greeks (Delta, Gamma, Theta, Vega) are affecting the position’s value in real time, not just at the theoretical expiration point.

- Trading Illiquid Options: Options with low open interest and trading volume typically have wide bid-ask spreads. This makes it difficult to enter and exit positions at favorable prices, increasing transaction costs and potentially turning a theoretically profitable trade into a loser.

- Avoidance: Before trading any option series, check its open interest and daily volume. Stick to options that are actively traded to ensure better liquidity and tighter spreads.

Key Risk Management Techniques for Retail Traders

Effective risk management is not just about avoiding mistakes; it’s about proactively implementing techniques to protect capital and optimize trading outcomes.

- Position Sizing: This is a cornerstone of risk management. By risking only a small, predetermined percentage or dollar amount of total trading capital on any single trade (e.g., 1-2%), a trader can withstand a string of losses without depleting their account. Consistent position sizing also helps to reduce the emotional impact of any single trade, promoting more rational decision-making.

- Stop-Loss Orders (with caveats for options): While setting stop-loss orders to define a maximum loss point is a common risk management tool in stock trading, their application to options requires care. Options can be highly volatile, and wide bid-ask spreads can cause stop orders to be triggered prematurely by normal market fluctuations rather than a genuine change in the trade’s outlook. For options, risk is often better managed through:

- Strategy Selection: Choosing defined-risk strategies (like vertical spreads, iron condors, or butterfly spreads) where the maximum possible loss is known at the outset.

- Mental Stops or Alerts: Setting price levels at which a position will be manually reviewed and potentially closed.

- Active Monitoring: Regularly reviewing open positions and closing them if the market moves against the initial thesis or if risk limits are approached.

- Hedging with Options: Options themselves can be powerful risk management tools. A common example is the protective put, where an investor holding a stock buys put options to protect against a price decline in that stock, effectively setting a floor for their potential loss. Other strategies, like collars, also serve hedging purposes.

- Using Spread Strategies for Defined Risk: As mentioned, many spread strategies (e.g., bull call spreads, bear put spreads, iron condors, butterfly spreads) have inherently limited maximum loss potential. Constructing trades where the worst-case scenario is known and acceptable is a fundamental risk control technique.

- Understanding and Managing Margin Requirements: Certain options strategies, particularly selling naked options or some complex spreads, require the use of a margin account and have specific margin requirements. If the market moves adversely, a margin call may occur, requiring the trader to deposit additional funds or face forced liquidation of positions. Overleveraging through margin is a significant risk that must be carefully managed. Traders should fully understand their broker’s margin policies before engaging in such strategies.

- Diversification: While options trading often focuses on a specific underlying asset, the principle of diversification still applies. This can mean diversifying across different underlying assets, different strategies, and different market outlooks to avoid concentrating risk in one area.

- Rolling Positions: Rolling is an active management technique where an existing option position is closed and a new one is simultaneously opened with a different strike price, a later expiration date, or both. This can be used to:

- Give a trade more time to work out if the outlook remains valid, but the timing was off.

- Adjust strike prices to lock in partial profits or reduce risk if the underlying has moved.

- Manage assignment risk on short options nearing expiration.

Rolling should be considered a new trade and evaluated on its own merits.

Developing a Trading Plan and Maintaining Discipline

The adage “plan the trade and trade the plan” is particularly pertinent in options trading. A well-thought-out trading plan is a roadmap that guides decisions and helps to mitigate emotional influences. Such a plan should clearly define:

- Investment Goals and Risk Tolerance: What is the trader trying to achieve, and how much risk are they comfortable taking?

- Market Outlook: A clear view on the likely direction, magnitude, and timing of the underlying asset’s price movement, as well as expectations for volatility.

- Strategy Selection: Choosing an options strategy that aligns with the market outlook and risk tolerance.

- Entry Criteria: Specific conditions or signals that will trigger the initiation of a trade.

- Exit Criteria: Predetermined levels for taking profits and cutting losses. This includes defining the maximum acceptable loss for any trade.

- Position Sizing Rules: How much capital will be allocated to each trade.

- Review and Adjustment Process: How and when trades will be monitored and potentially adjusted.

Maintaining the discipline to stick to this plan, especially during periods of market stress or unexpected price movements, is critical for consistent performance.

The Role of Continuous Learning and Paper Trading

The options market is dynamic, with new products, strategies, and market conditions emerging over time. Therefore, continuous learning is essential for any serious options trader. This includes staying updated on market trends, understanding new strategies, and refining one’s analytical skills.