What is a SPAC? Your Guide to Wall Street’s “Blank Check” Companies

Special Purpose Acquisition Companies, or SPACs, have moved from a niche corner of the financial world to a mainstream topic of discussion, attracting everyone from seasoned institutional funds to everyday retail investors. Despite their surge in popularity, they remain one of the most misunderstood investment vehicles. This guide will demystify SPACs, providing a comprehensive roadmap for navigating this unique landscape, from understanding the basic mechanics to implementing sophisticated investment strategies.

Demystifying the SPAC: A Simple Definition for Beginners

At its core, a Special Purpose Acquisition Company (SPAC) is a publicly-traded shell company created with the sole purpose of raising capital to acquire an existing private company, thereby taking it public. Because SPACs have no commercial operations of their own at the time of their initial public offering (IPO), they are often referred to as “blank check companies”. Investors who buy into a SPAC’s IPO are essentially writing a blank check to an experienced management team, known as “sponsors,” trusting them to find and merge with a promising private business within a set timeframe.

This structure can be thought of as a publicly-traded venture capital fund that is mandated to make only one major investment. When investors purchase shares in a pre-merger SPAC, they are not buying a piece of an existing business with revenues and products; they are backing the sponsors’ expertise and their stated investment thesis, which is often focused on a particular industry or geographic region.

How SPACs Work: The Journey from IPO to Acquisition

The lifecycle of a SPAC can be broken down into two primary phases. The first phase involves the creation and IPO of the SPAC itself. The second, more transformative phase is the merger process, commonly known as the “de-SPAC” transaction, where the blank check company combines with a target operating business.

A crucial element of the SPAC structure is the trust account. After the SPAC raises money in its IPO, nearly all the proceeds are placed into this interest-bearing trust, where they are typically invested in low-risk U.S. government bonds. These funds are protected and cannot be used for the SPAC’s operational expenses; they are reserved exclusively for funding the future acquisition or for returning capital to shareholders if a deal is not completed.

The sponsors are given a specific deadline, usually 18 to 24 months, to identify a target company and finalize a merger. This deadline creates a sense of urgency for the management team. If they fail to complete an acquisition within this window, the SPAC is forced to liquidate. In this scenario, the funds held in the trust account, along with any accrued interest, are returned to the public shareholders, and the company dissolves.

SPACs vs. Traditional IPOs: Key Differences Every Investor Should Know

While both SPACs and traditional IPOs serve the same ultimate function, taking a private company public, their processes and implications for investors are vastly different. The choice between these two paths often depends on the target company’s maturity, its industry, and the prevailing market conditions.

The structural characteristics of SPACs, particularly the ability to negotiate a valuation upfront and use forward-looking financial projections, make them an especially suitable vehicle for companies in emerging and high-growth sectors. A traditional IPO process, with its heavy reliance on historical financial performance and intense regulatory scrutiny, is better suited for mature companies with established track records. In contrast, a company in a field like electric aviation or commercial space travel, whose value is predicated on future potential rather than past profits, can use the SPAC merger framework to present its long-term vision and projections directly to investors. This fundamental difference explains why many of the most high-profile SPAC deals have involved these so-called “story stocks,” where the investment thesis is built on a compelling narrative about the future.

The following table provides a clear comparison of the key distinctions between the two methods:

| Feature | SPAC Merger | Traditional IPO |

| Timeline to Go Public | Determined by the underwriter and market demand through a “book-building” process. | Slower: Typically 6-12+ months of preparation and regulatory review. |

| Valuation Method | Privately negotiated between the company and the SPAC sponsor. | Determined by underwriter and market demand through a “book-building” process. |

| Price Certainty | Higher. The valuation is fixed in the merger agreement, providing more certainty. | Lower. The final IPO price is subject to market sentiment and volatility up to the day of listing. |

| Use of Projections | Permitted. Companies can provide forward-looking financial projections to investors. | Generally restricted. Disclosures are limited to historical financial performance. |

| Upfront Costs | Lower for the target company, as underwriting fees are paid by the SPAC. | Higher, with significant underwriting, legal, and marketing fees paid by the company. |

| Investor Base | Initially consists of arbitrage funds and blank-check investors; shifts post-merger. | Targeted towards institutional and retail investors from the outset. |

| Historical Performance | Tends to underperform the market significantly post-merger. | Varies, but has a generally better track record of post-listing performance. |

The Anatomy of a SPAC Investment: Understanding Units, Shares, and Warrants

To invest in SPACs effectively, it is essential to understand the unique securities they issue. Unlike a typical stock purchase, an initial investment in a SPAC often involves a bundle of securities: units, shares, and warrants, each with distinct characteristics and a specific role in the investment’s potential risk and reward profile.

Breaking Down the SPAC Unit: What You’re Really Buying

When a SPAC conducts its IPO, it typically does not sell common stock directly. Instead, it offers “units” to the public, almost always at a standard price of $10.00 per unit. A unit is a packaged security, a bundle containing two separate components: one share of common stock and a fraction of a warrant to purchase another share in the future. For example, a unit might consist of one share and one-half of a warrant.

After the IPO, these units trade on a stock exchange under a single ticker symbol, often ending with the letter “U”. After a set period, typically 52 days, the components of the unit can be “split” or separated. At this point, the common shares and the warrants begin trading independently on the exchange, each with its own distinct ticker symbol. This separation allows investors to trade the individual components based on their specific investment strategy.

The Power of Warrants: Your Ticket to Potential Leveraged Returns

Warrants are a key feature of the SPAC structure and a primary source of potential returns for early investors. A warrant is a financial contract that gives the holder the right, but not the obligation, to purchase a specified number of common shares at a predetermined price, known as the “exercise” or “strike” price, before a specific expiration date. For most SPACs, the exercise price is set at $11.50 per share.

These warrants serve as a “sweetener” to entice investors to commit their capital to a blank-check company with an uncertain future. Because IPO investors receive these warrants as part of the unit, they essentially get a free option on the future success of the company.

A critical detail for investors to understand is the concept of fractional warrants. Since units often contain only a fraction of a warrant (e.g., 1/3 or 1/2), an investor must accumulate enough fractions to form a whole warrant before it can be exercised or traded. For instance, an investor who bought three units, each containing one-third of a warrant, would own one whole warrant. Warrants typically have a long lifespan, often expiring five years after the completion of the business combination, but they will become worthless if the stock price does not rise above the exercise price before the expiration date.

Your Safety Net: Understanding Shareholder Votes and Redemption Rights

The SPAC structure contains a powerful investor protection mechanism: the redemption right. When a SPAC announces a proposed merger, it must secure the approval of its public shareholders through a vote. In connection with this vote, every public shareholder is given the option to “redeem” their shares.

Redemption allows an investor to exchange their common shares for their pro-rata share of the cash held in the trust account, which is typically the initial $10.00 investment plus any interest earned. This feature acts as a capital-preservation tool, providing a floor value for the shares and allowing investors to exit their position if they are not confident in the proposed merger or simply wish to cash out.

A pivotal evolution in the SPAC market, often dubbed “SPAC 2.0,” was the decoupling of the shareholder vote from the redemption decision. In the modern structure, an investor can vote in favor of a merger, helping it meet the approval threshold, while simultaneously choosing to redeem their shares for cash. This creates a highly advantageous situation for early investors. They can help ensure the deal closes, which is the only way their warrants will have any value, while still getting their initial investment back. This right to redeem is the cornerstone of what makes a pre-merger SPAC a relatively low-risk investment.

The combination of these features, a redeemable share backed by cash in a trust and a warrant offering upside potential, creates a unique asymmetrical risk-reward profile. The cash in the trust, invested in secure government bonds, establishes a stable floor value for the investment. The redemption right gives investors a guaranteed exit at or near this floor value, effectively minimizing downside risk. Meanwhile, the warrant and the potential for the stock to appreciate after a successful merger represent a call option on the future of the combined company. This structure, often described as owning a “bond with a call option,” is the fundamental principle that underpins the low-risk arbitrage strategies that have become popular among sophisticated SPAC investors.

How to Invest in SPACs: A Step-by-Step Guide for Retail Investors

With a foundational understanding of what SPACs are and the securities they comprise, the next step is to learn the practicalities of investing. This involves knowing where to find potential opportunities, selecting the right trading platform, and understanding the mechanics of executing a trade.

Finding Your Target: Where to Research Active and Upcoming SPACs

The SPAC market is dynamic, with new companies constantly going public and existing ones announcing mergers. Staying informed requires access to reliable data sources. Fortunately, several specialized resources cater to SPAC investors:

- Specialized Data Providers: Websites like SPAC Research, SPACInsider, and SPAC Analytics are invaluable tools. They provide comprehensive databases of all active SPACs, including those currently searching for a target, those that have announced a deal, and those that have recently completed a merger. These platforms track key data points such as the amount of cash in trust, the deadline to find a deal, and the composition of the units.

- Stock Exchanges: Major exchanges where SPACs are listed, such as Nasdaq, also offer lists and information on their SPAC offerings, often highlighting recent activity and market trends.

- Regulatory Filings: For the most direct and detailed information, investors should consult the SEC’s EDGAR database. This is where all official company filings are stored. The most important document for a pre-deal SPAC is its Form S-1, which is the prospectus filed for its IPO. It contains exhaustive details about the sponsor team, the target industry, the terms of the founder shares, and the structure of the warrants.

Choosing Your Platform: The Best Brokerages for SPAC Trading

Investing in SPACs does not require a specialized account. Because their units, shares, and warrants are publicly traded securities, they can be bought and sold through most major online brokerage platforms. When choosing a broker, consider factors like fees, research tools, and user interface. Some of the top platforms for retail investors include:

- Fidelity: Widely regarded as one of the best overall brokers, Fidelity offers commission-free trading of stocks and ETFs, a robust suite of research tools, and a user-friendly platform suitable for both beginners and experienced investors.

- Charles Schwab: Known for its excellent customer service and extensive educational resources, Schwab is another top-tier choice, particularly for those new to investing. It also offers commission-free trades.

- Robinhood: For investors who prioritize a simple, mobile-first experience, Robinhood provides an easy-to-use interface for trading SPACs without commissions.

- Interactive Brokers: Geared towards more active and professional traders, Interactive Brokers offers advanced trading tools, global market access, and is a good option for those looking to trade warrants specifically.

- dSPAC: For those who want a platform entirely dedicated to this asset class, dSPAC offers a customized dataset, a SPAC-specific search tool, and commission-free trading, along with features to manage corporate actions like unit separations and redemptions.

Placing Your First Trade: A Practical Walkthrough

Once an account is set up and a specific SPAC has been identified, the process of buying it is similar to purchasing any other stock or ETF. SPACs trade under ticker symbols just like regular companies. As mentioned, units often end in “U,” while common shares and warrants will have their own unique tickers after they separate.

Here is a general guide to placing a trade on a typical platform:

- Log in and Select Your Account: Choose the brokerage account from which to make the purchase.

- Find the Security: Enter the ticker symbol for the SPAC unit (e.g., “SPACU”), common share (e.g., “SPAC”), or warrant (e.g., “SPACW”).

- Initiate a Trade Order: Select the “Trade” or “Buy” option.

- Specify Order Details:

- Action: Choose “Buy.”

- Quantity: Enter the number of shares/units you wish to purchase or the total dollar amount you want to invest.

- Order Type: Select either a “Market” order or a “Limit” order. A market order executes immediately at the best available current price, prioritizing speed over price. A limit order allows the investor to set a maximum price they are willing to pay, prioritizing price control over immediate execution. For a less liquid security like a SPAC, using a limit order is often recommended to avoid paying more than intended.

- Time-in-Force: Decide how long the order should remain active (e.g., “Day” order, which expires at the end of the trading day, or “Good ’til Canceled”).

- Review and Submit: Carefully review the order details, ticker, quantity, price, and estimated cost. If everything is correct, confirm and place the order.

For investors seeking diversified exposure without picking individual SPACs, exchange-traded funds (ETFs) that focus on this asset class, such as The De-SPAC ETF (DSPC) or The SPAC and New Issue ETF (SPCX), can be purchased through these same brokerage platforms.

The Art of Due Diligence: How to Pick a Winning SPAC

Investing in a SPAC before it has announced a merger target is a unique proposition. With no business operations or financial history to analyze, the investment decision hinges almost entirely on one factor: the quality and credibility of its sponsors. A thorough evaluation of the management team is the most critical piece of due diligence an investor can perform.

It’s All About the Sponsor: Evaluating the Management Team

In a blank-check company, the sponsor team is the company. Their experience, network, and incentives will dictate the quality of the eventual merger target and the potential for shareholder returns. A rigorous assessment should focus on several key attributes:

- Track Record: The most reliable indicator of future success is past performance. Investors should investigate whether the sponsors have led previous SPACs. If so, what were the outcomes? Did they successfully complete a merger? How has the stock of the de-SPACed company performed over time? A history of creating long-term shareholder value is a significant green flag, while a record of value-destructive deals or failed SPACs is a major warning.

- Industry Expertise: A strong sponsor team will possess deep operational and investment experience within the industry it intends to target. A team of seasoned healthcare executives and investors is more likely to identify a high-quality biotech firm than a team of generalists. This expertise not only helps in sourcing proprietary deals but also in conducting effective due diligence on the target and adding operational value post-merger.

- Network Centrality: Academic research has shown a strong correlation between a sponsor’s network and the success of their SPAC. Sponsors with extensive and high-quality connections within the private equity and venture capital communities are better positioned to source superior, off-market deals. This network can also help validate the target company and facilitate additional financing, such as a PIPE, if needed. A well-connected sponsor is a value-add, not just a deal-finder.

- Alignment and Incentives (“Skin in the Game”): Investors should look for sponsors who have a significant amount of their own capital at risk. This typically comes in the form of purchasing private placement warrants to fund the SPAC’s operating expenses. A sponsor with a substantial financial stake is more likely to be disciplined. A key qualitative factor is a sponsor’s willingness to liquidate the SPAC and return capital to shareholders if a suitable deal cannot be found, rather than rushing into a subpar merger simply to avoid a total loss on their at-risk capital.

This emphasis on sponsor quality has become even more critical in the current market. The speculative frenzy of 2020 and 2021 attracted a wide array of sponsors, some with limited experience, which contributed to a wave of poor-quality deals and subsequent underperformance. In response, new SEC regulations effective in July 2024 have increased the disclosure requirements and legal liabilities for SPAC sponsors and target companies. This more stringent regulatory environment creates a higher barrier to entry, naturally favoring experienced, reputable sponsors who are equipped to navigate the complexities of public company governance. Market data from 2024 and 2025 already indicates a “flight to quality,” with the majority of new SPAC IPOs being led by “serial sponsors”, those with a history of multiple SPACs. For a retail investor today, the most effective initial screen is to focus on these proven, repeat players, as they are most likely to have the reputation, discipline, and expertise to succeed in this more mature market phase.

Reading the Fine Print: What to Look for in an S-1 Filing

The IPO prospectus, or Form S-1, is the definitive source of information for a pre-deal SPAC. While dense, it contains crucial details that can inform an investment decision. Key areas to scrutinize include:

- Management Biographies: This section provides the professional history of the sponsor team. Look for the specific operational and transactional experience that aligns with their stated investment thesis.

- Target Sector: The S-1 will outline the industry or sector the SPAC intends to target. While this is not a binding commitment, it provides insight into the sponsors’ area of focus and expertise.

- Securities Offered: Review the terms of the units, paying close attention to the warrant coverage (e.g., one-half or one-third of a warrant per unit) as this impacts the potential upside.

- Founder Shares (The “Promote”): The prospectus will detail the number of shares the sponsor receives for a nominal price. This typically amounts to 20% of the post-IPO equity and represents the inherent dilution investors face from the outset.

- Risk Factors: This section discloses potential issues, including the intense competition for high-quality targets and the inherent conflicts of interest between the sponsor and public shareholders.

Assessing the Target Industry and Market Opportunity

Even without a specific company to analyze, an investor can evaluate the merits of the SPAC’s chosen hunting ground. Consider whether the target industry, often technology, media, telecom (TMT), or healthcare, is poised for significant growth and innovation. Assess whether the sector is driven by sustainable, long-term trends or if it is susceptible to short-term hype and speculative bubbles, which can increase investment risk. A strong sponsor targeting a fundamentally sound industry is a more compelling proposition than one chasing a fleeting trend.

Profitable SPAC Trading Strategies: From Low-Risk Arbitrage to High-Growth Speculation

Investing in SPACs is not a one-size-fits-all endeavor. The unique lifecycle of a SPAC creates opportunities for several distinct strategies, each with its own risk-reward profile. These strategies range from conservative, capital-preservation approaches to highly speculative, high-growth plays. Understanding these different methods allows an investor to align their SPAC investments with their personal risk tolerance and financial goals.

Strategy 1: Pre-Merger Arbitrage – The “Bond with a Call Option” Approach

Core Logic: SPAC arbitrage is a low-risk, event-driven strategy designed to generate returns similar to a short-term bond, but with the added bonus of significant upside potential. It is predicated on the structural safety net provided by the SPAC’s trust account and redemption feature.

How it Works: The strategy involves buying SPAC units or shares in the secondary market at a price at or, ideally, below their Net Asset Value (NAV). The NAV is the per-share cash value held in the trust, which starts at $10.00 and gradually increases as the U.S. Treasury bills it is invested in accrue interest.

- Acquisition: The investor identifies a SPAC whose shares are trading at a discount to its current NAV. For example, if a SPAC has $10.20 per share in its trust but its stock is trading at $10.10, there is a $0.10 discount.

- Holding Period: The investor holds the shares, earning a yield from the interest accruing in the trust and the eventual closing of the discount to NAV.

- The Decision Point: When the SPAC announces a merger, the arbitrageur evaluates the market’s reaction.

- Positive Reaction: If the announced deal is well-received, speculative interest can drive the stock price significantly above its NAV (e.g., to $12.00 or higher). In this case, the investor sells their shares on the open market, realizing a substantial profit.

- Negative or Neutral Reaction: If the market dislikes the deal or is indifferent, the stock price will likely remain at or below its NAV. The investor then simply exercises their redemption right, getting back the full NAV (e.g., $10.20) from the trust account. They have preserved their capital and earned a small, bond-like return.

Sources of Return: The profit from this strategy comes from a combination of the yield on the trust assets, capturing the price discount to NAV, and the valuable upside optionality if a favorable deal is announced.

Primary Risks: This strategy is considered one of the lowest-risk strategies in the investment world. The primary risk is not a loss of principal but rather opportunity cost; the capital could have been deployed elsewhere. There is a small risk of loss if an investor is forced to sell their position during a moment of extreme market panic when even safe-haven assets can trade at unusual discounts.

Strategy 2: Merger Announcement Trading – Capitalizing on Market Hype

Core Logic: This is a high-risk, high-reward momentum strategy that seeks to profit from the intense price volatility that often follows the announcement of a SPAC merger. It is a speculative play on market sentiment rather than fundamental value.

How it Works: This approach focuses on the period between the deal announcement and the merger closing.

- Identify a Catalyst: The trader monitors news and data sources for merger announcements, particularly those involving companies in “hot” sectors like electric vehicles, fintech, or artificial intelligence.

- Trade the Momentum: A deal with a well-known, high-growth target can trigger a frenzy of buying from retail and institutional investors, causing the SPAC’s stock price to skyrocket far above its NAV. The trader aims to ride this wave of positive sentiment, buying into the initial surge and selling before the hype subsides.

- Exit Before Closing: Often, the goal is to exit the position before the merger is finalized. Once the de-SPAC transaction is complete, the stock’s price becomes more tethered to the company’s actual financial performance and is exposed to the full weight of share dilution, which can cause the initial excitement to fade.

Primary Risks: This strategy is extremely risky. The investor is buying shares at a significant premium to their cash value, completely forgoing the NAV safety net. The price is driven by speculation, and sentiment can reverse in an instant, leading to rapid and substantial losses. The case of Churchill Capital Corp IV, which soared above $57 on rumors of a deal with Lucid Motors before collapsing, is a stark reminder of the dangers of chasing hype.

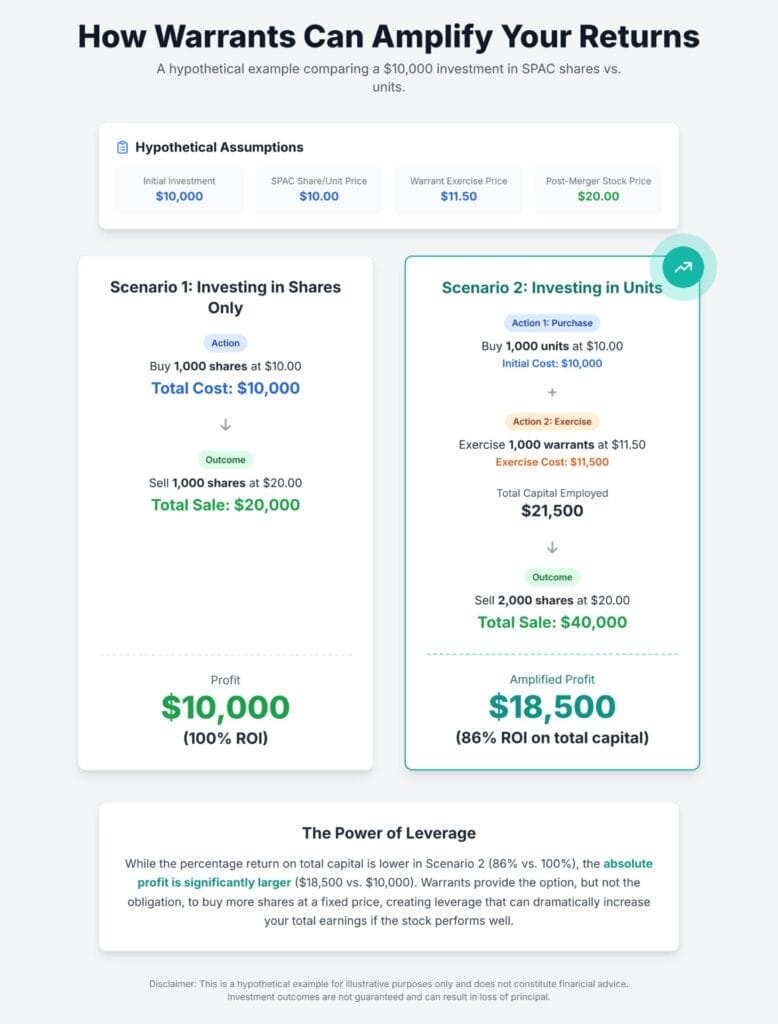

Strategy 3: Leveraging Warrants for Outsized Gains

Core Logic: Warrants provide a capital-efficient way to gain leveraged exposure to a SPAC’s upside. Because warrants are cheaper than common shares, a relatively small investment can control the same number of underlying shares, amplifying potential returns.

How it Works: An investor can buy warrants directly on the open market, often for just a few dollars each. The value of a warrant is derived from the price of the underlying common stock.

- Acquire Warrants: Purchase warrants of a SPAC that is expected to complete a successful merger, leading to a significant increase in its stock price post-merger.

- Profit from Appreciation: If the common stock price rises well above the warrant’s $11.50 exercise price, the warrant’s price will increase at an even faster percentage rate. For example, if the stock moves from $12 to $18 (a 50% increase), the intrinsic value of the warrant moves from $0.50 ($12.00 – $11.50) to $6.50 ($18.00 – $11.50), a 1200% increase.

- Realize Gains: The investor can either sell the appreciated warrants on the open market or exercise them to buy the common stock at the discounted $11.50 price, then sell the stock for its current market price.

Primary Risks: Warrants are highly speculative. If the post-merger stock fails to trade above the $11.50 exercise price before the warrant’s expiration date (typically 5 years post-merger), the warrants will expire worthless, resulting in a 100% loss of the capital invested in them. Furthermore, many warrants contain redemption clauses that allow the company to force investors to exercise them early if the stock price trades above a certain level (e.g., $18.00) for a sustained period, which can limit the potential upside.

Strategy 4: Long-Term Investing in Post-Merger Companies

Core Logic: This strategy involves buying or holding shares after the de-SPAC merger is complete, with the intention of participating in the long-term growth of the underlying business. This is a traditional, fundamental-based investment approach.

The Sobering Reality: Before pursuing this strategy, investors must confront a difficult truth: historical data overwhelmingly shows that the majority of companies taken public via SPACs significantly underperform the broader market in the months and years following their merger. Studies have documented severe negative returns on average, with underperformance worsening over time. This is largely due to the high costs and shareholder dilution inherent in the SPAC structure, which create a massive headwind for the stock.

How to Approach (with Extreme Caution):

- Wait for the Dust to Settle: Avoid buying into the pre-merger hype. After a de-SPAC, there is often a period of high volatility and “shareholder churn” as early-stage investors and arbitrageurs sell their positions. It is often prudent to wait for this selling pressure to subside.

- Conduct Deep Fundamental Analysis: Treat the de-SPACed company as a new investment. Ignore the sponsor’s initial projections and conduct fresh, rigorous due diligence on the operating business. Analyze its financial statements, revenue growth, path to profitability, competitive advantages, and the quality of its management team.

- Account for Dilution: Fully understand the company’s capital structure. Factor in the total number of shares outstanding, including those from the sponsor’s promote, as well as the potential future dilution from all outstanding warrants. This will provide a more realistic picture of the company’s valuation.

Primary Risks: The risks are substantial. The investor bears the full operational risk of what is often a young, unprofitable company, compounded by the structural disadvantages of its path to the public market. The poor historical track record of de-SPACed companies suggests that the odds are stacked against long-term investors.

The Risks and Realities of SPAC Investing

While SPACs offer an innovative and accessible route to public markets, they are fraught with structural complexities, inherent risks, and potential conflicts of interest that every investor must understand. A clear-eyed view of these challenges is essential for making informed decisions and avoiding common pitfalls.

The Hidden Cost: How Dilution Crushes Returns

One of the most significant and often misunderstood risks of SPAC investing is shareholder dilution. While a SPAC share is nominally priced at $10.00, the actual amount of cash backing that share by the time of a merger is substantially lower. Research from academic institutions like Stanford and Yale has shown that due to the various costs embedded in the structure, the median SPAC holds only about $5.70 to $6.67 in cash per share when it merges. This massive gap is the “cost” of the SPAC, a cost borne almost entirely by the shareholders who remain invested through the merger.

This dilution stems from three primary sources:

- The Sponsor Promote: The most significant dilutive element is the “promote,” where sponsors are awarded shares equivalent to 20% of the SPAC’s post-IPO equity for a nominal investment. This is their primary compensation for finding a deal, but it immediately dilutes the value of the shares sold to the public.

- Underwriting Fees: SPACs pay investment banks an underwriting fee, typically 5.5% of the gross IPO proceeds. Critically, this fee is not reduced when shareholders redeem their shares. If a SPAC sees a high redemption rate (which is common), the effective fee as a percentage of the remaining capital can become exorbitant.

- Warrants: The warrants issued to IPO investors represent a future claim on the company’s equity. Their value is a direct cost that dilutes the ownership stake of common shareholders who hold through the merger.

Conflicts of Interest: Is the Sponsor Working for You?

The SPAC structure creates a fundamental misalignment of incentives between the sponsors and the public shareholders. Sponsors typically invest a relatively small amount of “at-risk” capital to cover the SPAC’s IPO and operational costs. If they successfully complete a merger within their two-year window, their promote shares convert into a stake worth tens or even hundreds of millions of dollars. However, if they fail to find a deal, the SPAC liquidates, and their entire initial investment is lost.

This binary outcome creates immense pressure to complete any deal, regardless of its quality or valuation. A sponsor can still realize a substantial profit from their promote even if the merged company’s stock performs poorly and public shareholders suffer significant losses. This incentive structure can lead sponsors to overpay for a target or merge with a lower-quality company simply to avoid the alternative of a total loss, a conflict that directly opposes the interests of long-term investors.

Cautionary Tales: Lessons from High-Profile Cases

The theoretical risks of SPAC investing have been borne out in numerous real-world examples, leading to significant investor losses and a surge in litigation. De-SPACed companies are sued at a considerably higher rate, around 17%, compared to companies that go public via a traditional IPO (13%) or mature public companies (3%).

- Case Study: Churchill Capital Corp IV (Lucid Motors). This case serves as a powerful example of the dangers of speculative hype and alleged misrepresentation. As rumors of a potential merger with the electric vehicle maker Lucid Motors circulated, the SPAC’s stock price surged from its $10 NAV to a high of over $57. The excitement was fueled by media appearances from Lucid’s CEO, who mentioned plans to deliver 6,000 vehicles in 2021. However, when the merger was officially announced on February 22, 2021, filings revealed that production was delayed and the actual plan was for only 557 vehicles. The stock price collapsed, and a federal securities class-action lawsuit was filed, alleging that the SPAC, its sponsors, and the target company had made false and misleading statements that resulted in massive losses for shareholders who bought in at inflated prices.

- Case Study: Hennessy Capital (Canoo). This case highlights the risks surrounding inadequate disclosure. The lawsuit alleged that Hennessy’s proxy statement promoted the business model of its EV target, Canoo, focusing on engineering services and a subscription-based sales model. However, plaintiffs claimed that the company was already engaging consultants to “reboot” this very business model before the merger vote. When the newly public company announced a significant strategic shift away from these core tenets just three months after the merger, the stock price fell, and shareholders sued. They argued that material information about the impending changes was known or knowable pre-merger and was not disclosed, preventing them from making an informed redemption decision.

These cases underscore the importance of skeptical due diligence and the real financial and legal risks that can materialize when speculative enthusiasm collides with operational reality.

The Future of SPACs: Market Trends and the New Regulatory Landscape

The SPAC market is in a state of evolution. After the unprecedented boom of 2020-2021 and the subsequent bust in 2022-2023, the landscape is now being reshaped by new regulatory pressures and a more discerning investor base. Understanding these current trends is key to navigating the future of SPAC investing.

The SPAC Market in 2024-2025: A Return to Quality?

The data paints a clear picture of a market cycle. In 2021, at the peak of the frenzy, 613 SPAC IPOs raised over $162 billion. This was followed by a sharp contraction, with only 31 SPAC IPOs in 2023. However, 2024 and the first half of 2025 have shown signs of a modest but meaningful recovery. In 2024, there were 57 SPAC IPOs, and issuance has seen a sharp resurgence in the first half of 2025, with 53 SPACs raising over $9.5 billion.

While overall activity remains far below the 2021 peak, several key trends are emerging in this new phase, often dubbed “SPAC 4.0”:

- Dominance of Serial Sponsors: The rebound is not broad-based. It is being driven primarily by experienced, “serial” sponsors, management teams with a history of launching multiple SPACs. In the first quarter of 2025, approximately 80% of new SPAC IPOs were from these repeat issuers. This suggests a “flight to quality,” where investors are now prioritizing proven track records over speculative narratives.

- Muted De-SPAC Activity: While IPO issuance has picked up, the pace of completed mergers remains subdued. This indicates that investor scrutiny of potential deals is much tighter, and the bar for a private company to successfully merge with a SPAC is higher than it was during the boom.

- Emergence of New Themes: The market continues to evolve, with new sectors attracting interest. For instance, 2025 has seen the rise of SPACs focused on acquiring companies in the cryptocurrency space, particularly those that can serve as public bitcoin treasury vehicles, injecting fresh enthusiasm into the market.

How the New SEC Rules (Effective July 2024) Are Changing the Game

A major catalyst for the market’s evolution is the implementation of new rules by the U.S. Securities and Exchange Commission, which took effect on July 1, 2024. The overarching goal of these regulations is to provide SPAC investors with protections and disclosures that are more comparable to those in a traditional IPO.

Key changes that directly impact investors include:

- Enhanced Disclosures: The rules mandate far more detailed and transparent disclosures regarding the sponsor’s compensation, their potential conflicts of interest, and the sources and extent of shareholder dilution. This information must be clearly presented, making it easier for investors to understand the true costs of a SPAC transaction.

- Increased Liability: In a significant shift, the private target company is now considered a “co-registrant” in the de-SPAC transaction filings. This means its directors and officers are subject to the same strict liability for any material misstatements or omissions as they would be in a traditional IPO. This change is expected to lead to more rigorous due diligence by all parties.

- Greater Scrutiny of Projections: The new rules eliminate the legal safe harbor from the Private Securities Litigation Reform Act (PSLRA) for forward-looking statements, including financial projections, made in connection with a de-SPAC transaction. This exposes companies to a higher risk of lawsuits over overly optimistic forecasts, which should encourage more realistic and defensible projections.

These regulatory changes are not merely administrative; they are poised to fundamentally alter the strategic calculus for SPAC investors. The speculative, hype-driven “merger announcement” strategy, which often relied on aggressive and unaudited projections, is now significantly riskier for the companies involved. The removal of the safe harbor will likely temper the kind of speculative narratives that fueled past frenzies.

Conversely, the strategies that rely on analytical rigor are strengthened. The new disclosure requirements provide investors with clearer data to assess sponsor quality and calculate the precise impact of dilution. This makes the “pre-merger arbitrage” strategy more transparent, as the true NAV and cost structure are easier to determine. It also enhances the “sponsor-focused” due diligence approach, as investors now have a richer, more standardized dataset to compare management teams. In essence, the new regulatory landscape systematically discourages purely speculative trading while empowering investors who engage in careful, data-driven analysis. The path to profitability in the SPAC 4.0 era will likely be paved with diligence, not just momentum.

Final Verdict: Are SPACs Right for Your Portfolio?

SPACs represent a complex and high-risk segment of the market. They offer a unique structure that can provide access to innovative, high-growth companies before they mature, but this opportunity comes with significant structural flaws, potential for misaligned incentives, and a historically poor track record of post-merger returns.

For the vast majority of retail investors, a cautious and strategic approach is paramount. The lower-risk strategies, such as pre-merger arbitrage, offer a compelling way to generate modest, bond-like returns with limited downside, making it the most prudent entry point for newcomers. For those seeking broader, more passive exposure, investing in a diversified SPAC ETF can mitigate the idiosyncratic risk of picking a single unsuccessful SPAC.

The more aggressive strategies, trading merger announcements, leveraging warrants, and making long-term bets on de-SPACed companies, should be reserved for experienced investors. These approaches require a deep understanding of market dynamics, a high tolerance for risk and volatility, and the capacity to conduct extensive, independent due diligence. The historical data strongly suggest that long-term, buy-and-hold investing in post-merger SPACs is a strategy fraught with peril and should be undertaken with extreme caution.

Ultimately, SPACs can be a component of a well-diversified portfolio, but they should not be its centerpiece. By understanding their unique lifecycle, appreciating the critical role of the sponsor, and choosing a strategy that aligns with one’s own risk profile, investors can navigate this evolving market with greater confidence and make informed, not impulsive, decisions.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial advice. Investing in financial markets involves risk, including the possible loss of principal. Always conduct your own research and consider consulting with a qualified financial advisor before making any investment decisions.

This website may utilize artificial intelligence to assist in the creation of content. This may include generating ideas, drafting sections, and aiding in the editing process. All content is reviewed and edited by us to ensure accuracy and quality.